Concerns over rising interest rates and expected further rate increases have hit several stocks hard during the fourth quarter of 2018. Trends reversed 180 degrees in 2019 amid Powell’s pivot and optimistic expectations towards a trade deal with China. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were increasing their overall exposure in the third quarter and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX).

Hedge fund interest in Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare ETTX to other stocks including Sears Hometown and Outlet Stores Inc (NASDAQ:SHOS), Arotech Corporation (NASDAQ:ARTX), and Community First Bancshares, Inc. (NASDAQ:CFBI) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 91% since May 2014 and outperformed the Russell 2000 ETFs by nearly 40 percentage points. Our short strategy outperformed the S&P 500 short ETFs by 20 percentage points annually (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a glance at the latest hedge fund action regarding Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX).

What have hedge funds been doing with Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX)?

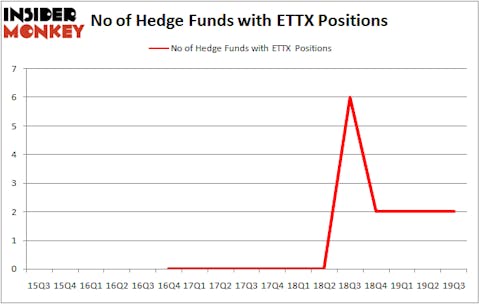

Heading into the fourth quarter of 2019, a total of 2 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards ETTX over the last 17 quarters. Hedge funds were really into ETTX a year ago when there were 6 hedge funds with bullish bets on the stock.

When looking at the institutional investors followed by Insider Monkey, Alan Frazier’s Frazier Healthcare Partners has the number one position in Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX), worth close to $8 million, corresponding to 2.5% of its total 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies founded by Jim Simons, with a $0.1 million position; less than 0.1%% of its 13F portfolio is allocated to the company. In terms of the portfolio weights assigned to each position Frazier Healthcare Partners allocated the biggest weight to Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX), around 2.52% of its portfolio.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Millennium Management. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Renaissance Technologies).

Let’s go over hedge fund activity in other stocks similar to Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX). These stocks are Sears Hometown and Outlet Stores Inc (NASDAQ:SHOS), Arotech Corporation (NASDAQ:ARTX), Community First Bancshares, Inc. (NASDAQ:CFBI), and Lantronix Inc (NASDAQ:LTRX). This group of stocks’ market caps are closest to ETTX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SHOS | 7 | 25475 | -1 |

| ARTX | 8 | 11444 | 2 |

| CFBI | 1 | 680 | 0 |

| LTRX | 2 | 2620 | 0 |

| Average | 4.5 | 10055 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4.5 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $8 million in ETTX’s case. Arotech Corporation (NASDAQ:ARTX) is the most popular stock in this table. On the other hand Community First Bancshares, Inc. (NASDAQ:CFBI) is the least popular one with only 1 bullish hedge fund positions. Entasis Therapeutics Holdings Inc. (NASDAQ:ETTX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately ETTX wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); ETTX investors were disappointed as the stock returned -18.8% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.