The SEC requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings discloses the funds’ positions on June 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Electronic Arts Inc. (NASDAQ:EA) based on those filings.

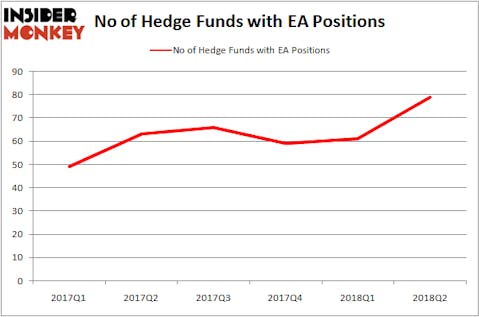

Electronic Arts Inc. (NASDAQ:EA) has experienced an increase in support from the world’s most elite money managers lately. EA was in 79 hedge funds’ portfolios at the end of the second quarter of 2018. There were 61 hedge funds in our database with EA positions at the end of the previous quarter. Moreover Electronic Arts Inc. is also the 20th most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds).

Electronic Arts was one of the stocks that was pitched at the GIBI Conference last year. Jeanie Wyatt liked Electronic Arts because the company enjoys higher margins due to going over the top (provides its products via Internet) than its peers that still focus on traditional distribution methods, like selling physical video games in stores. Moreover, Electronic Arts Inc. (NASDAQ:EA) has accelerating sales growth and has new upside in the e-sports segment. That was an accurate assessment as EA outperformed the market over the following 9 month period.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s review the new hedge fund action regarding Electronic Arts Inc. (NASDAQ:EA).

How are hedge funds trading Electronic Arts Inc. (NASDAQ:EA)?

At Q3’s end, a total of 79 of the hedge funds tracked by Insider Monkey were long this stock, a change of 30% from one quarter earlier. On the other hand, there were a total of 63 hedge funds with a bullish position in EA at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their stakes considerably (or already accumulated large positions).

The largest stake in Electronic Arts Inc. (NASDAQ:EA) was held by Coatue Management, which reported holding $923.7 million worth of stock at the end of June. It was followed by Lone Pine Capital with a $890.9 million position. Other investors bullish on the company included Carbonado Capital, DSAM Partners, and Egerton Capital Limited.

Consequently, specific money managers were breaking ground themselves. Discovery Capital Management, managed by Rob Citrone, initiated the most valuable position in Electronic Arts Inc. (NASDAQ:EA). Discovery Capital Management had $51.6 million invested in the company at the end of the quarter. James Parsons’s Junto Capital Management also made a $35.7 million investment in the stock during the quarter. The following funds were also among the new EA investors: David Forster and Peter Wilton’s IBIS Capital Partners, and Jacob Doft’s Highline Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Electronic Arts Inc. (NASDAQ:EA) but similarly valued. We will take a look at Relx PLC (ADR) (NYSE:RELX), Mizuho Financial Group Inc. (ADR) (NYSE:MFG), Barclays PLC (ADR) (NYSE:BCS), and Carnival plc (ADR) (NYSE:CUK). This group of stocks’ market caps match EA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RELX | 6 | 99068 | 0 |

| MFG | 4 | 7655 | 0 |

| BCS | 7 | 751512 | -1 |

| CUK | 8 | 56430 | 3 |

As you can see these stocks had an average of 6.25 hedge funds with bullish positions and the average amount invested in these stocks was $229 million. That figure was $6323 million in EA’s case. Carnival plc (ADR) (NYSE:CUK) is the most popular stock in this table. On the other hand Mizuho Financial Group Inc. (ADR) (NYSE:MFG) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks Electronic Arts Inc. (NASDAQ:EA) is more popular among hedge funds.

Having said that EA has been among the worst performing stocks since the beginning of this summer as as the company’s management is guiding lower than Wall Street analysts. For fiscal 2019, management guided for flat revenue growth, and slightly negative earnings. Personally I prefer PES2019 over FiFA, so never considered a position in EA. I don’t think EA is an attractively priced stock given its zero growth and sky high PE ratio.

Disclosure: None. This article was originally published at Insider Monkey.