Is Edwards Lifesciences Corp (NYSE:EW) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

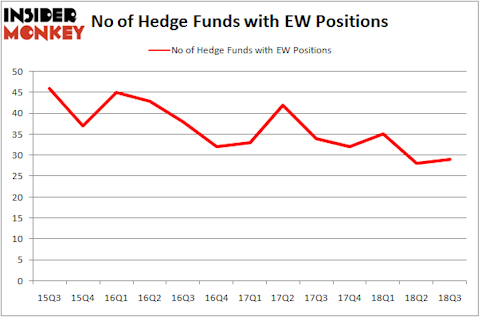

Is Edwards Lifesciences Corp (NYSE:EW) worth your attention right now? Investors who are in the know are betting on the stock. The number of long hedge fund bets rose by 1 in recent months, and the company was in 29 hedge funds’ portfolios at the end of September. In spite of this recent increase in enthusiasm for the stock, the number of bullish investors was far from enough for it to rank as one of the 30 most popular stocks among ALL hedge funds. Even though the stock wasn’t widely popular among hedge funds during the quarter, we still think it deserves our further attention, which is why in this article we are going to analyze it further and compare it with some other companies of similar market caps.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

“Edward Lifesciences results continue to benefit from the Company’s pioneering shift towards minimally invasive techniques and technologies for treating structural heart disease. Near-term, we think Edwards will benefit from a slate of new product launches to treat severe aortic stenosis.

Longer-term, we are becoming more confident that Edwards’ nascent, transcatheter mitral valve therapy (TMVT) portfolio has the potential to add a large and growing stream of profits to supplement current growth. Mitral valve therapy is not new, however their minimally invasive techniques – small suture-less procedures – are in their infancy. During the quarter, a competitor released important new clinical data that validated Edwards’ strategy in TMVT, but that also leaves room for the Company to offer differentiated approaches in what, we believe, could be a multibillion-dollar addressable market by the middle of the next decade.”

Regardless of Wedgewood Partners’ optimism for the stock, we are still not buying it, and would like to examine it furthermore, which is why we are now going to analyze the recent hedge fund action towards it.

How are hedge funds trading Edwards Lifesciences Corp (NYSE:EW)?

Heading into the fourth quarter of 2018, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the previous quarter. The graph below displays the number of hedge funds with bullish position in EW over the last 13 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, OrbiMed Advisors was the largest shareholder of Edwards Lifesciences Corp (NYSE:EW), with a stake worth $172.5 million reported as of the end of September. Trailing OrbiMed Advisors was Millennium Management, which amassed a stake valued at $141.6 million. Partner Fund Management, Arrowstreet Capital, and Healthcor Management LP were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, some big names have jumped into Edwards Lifesciences Corp (NYSE:EW) headfirst. Healthcor Management LP, managed by Arthur B Cohen and Joseph Healey, established the most valuable position in Edwards Lifesciences Corp (NYSE:EW). Healthcor Management LP had $79 million invested in the company at the end of the quarter. James Crichton’s Hitchwood Capital Management also made a $34.8 million investment in the stock during the quarter. The other funds with new positions in the stock are Dmitry Balyasny’s Balyasny Asset Management, Mario Gabelli’s GAMCO Investors, and Ray Dalio’s Bridgewater Associates.

Let’s now review hedge fund activity in other stocks similar to Edwards Lifesciences Corp (NYSE:EW). We will take a look at BCE Inc. (USA) (NYSE:BCE), AFLAC Incorporated (NYSE:AFL), Marathon Petroleum Corp (NYSE:MPC), and Fidelity National Information Services, Inc. (NYSE:FIS). All of these stocks’ market caps resemble EW’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BCE | 17 | 344957 | 1 |

| AFL | 29 | 922620 | 6 |

| MPC | 66 | 4796468 | 7 |

| FIS | 36 | 1952578 | 4 |

As you can see these stocks had an average of 37 hedge funds with bullish positions and the average amount invested in these stocks was $2 billion. That figure was $706 million in EW’s case. Marathon Petroleum Corp (NYSE:MPC) is the most popular stock in this table. On the other hand BCE Inc. (USA) (NYSE:BCE) is the least popular one with only 17 bullish hedge fund positions. Edwards Lifesciences Corp (NYSE:EW) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MPC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.