World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Is Dril-Quip, Inc. (NYSE:DRQ) a worthy investment right now? Prominent investors are in an optimistic mood. The number of bullish hedge fund positions moved up by 1 in recent months. Our calculations also showed that DRQ isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of tools stock traders use to assess their stock investments. Some of the less utilized tools are hedge fund and insider trading moves. We have shown that, historically, those who follow the top picks of the best hedge fund managers can outclass the market by a superb margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s view the recent hedge fund action regarding Dril-Quip, Inc. (NYSE:DRQ).

What does smart money think about Dril-Quip, Inc. (NYSE:DRQ)?

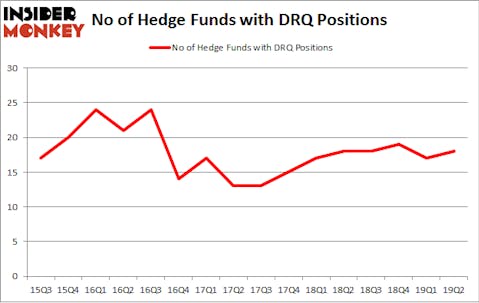

At the end of the second quarter, a total of 18 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 6% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards DRQ over the last 16 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Dril-Quip, Inc. (NYSE:DRQ), with a stake worth $84 million reported as of the end of March. Trailing Fisher Asset Management was GAMCO Investors, which amassed a stake valued at $29.9 million. Alyeska Investment Group, Birch Run Capital, and Two Sigma Advisors were also very fond of the stock, giving the stock large weights in their portfolios.

Now, some big names have jumped into Dril-Quip, Inc. (NYSE:DRQ) headfirst. Alyeska Investment Group, managed by Anand Parekh, assembled the largest position in Dril-Quip, Inc. (NYSE:DRQ). Alyeska Investment Group had $10.9 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $0.6 million position during the quarter. The other funds with brand new DRQ positions are Minhua Zhang’s Weld Capital Management and Steve Cohen’s Point72 Asset Management.

Let’s also examine hedge fund activity in other stocks similar to Dril-Quip, Inc. (NYSE:DRQ). These stocks are Osisko Gold Royalties Ltd (NYSE:OR), Matson, Inc. (NYSE:MATX), Callaway Golf Company (NYSE:ELY), and Park National Corporation (NYSE:PRK). This group of stocks’ market valuations are closest to DRQ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| OR | 12 | 41963 | 5 |

| MATX | 8 | 5690 | -1 |

| ELY | 20 | 215556 | -6 |

| PRK | 8 | 15051 | 3 |

| Average | 12 | 69565 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $70 million. That figure was $159 million in DRQ’s case. Callaway Golf Company (NYSE:ELY) is the most popular stock in this table. On the other hand Matson, Inc. (NYSE:MATX) is the least popular one with only 8 bullish hedge fund positions. Dril-Quip, Inc. (NYSE:DRQ) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on DRQ, though not to the same extent, as the stock returned 4.5% during the third quarter and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.