The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards White Mountains Insurance Group Ltd (NYSE:WTM).

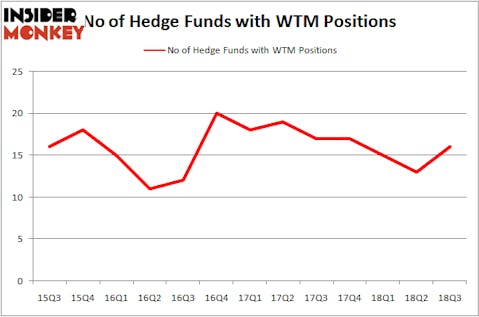

Is White Mountains Insurance Group Ltd (NYSE:WTM) a healthy stock for your portfolio? The best stock pickers are turning bullish. The number of long hedge fund bets went up by 3 in recent months. Our calculations also showed that WTM isn’t among the 30 most popular stocks among hedge funds. WTM was in 16 hedge funds’ portfolios at the end of the third quarter of 2018. There were 13 hedge funds in our database with WTM holdings at the end of the previous quarter.

In the financial world there are a large number of tools stock market investors can use to evaluate publicly traded companies. A duo of the most under-the-radar tools are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best money managers can outclass the S&P 500 by a superb amount (see the details here).

We’re going to take a glance at the fresh hedge fund action surrounding White Mountains Insurance Group Ltd (NYSE:WTM).

Hedge fund activity in White Mountains Insurance Group Ltd (NYSE:WTM)

At the end of the third quarter, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of 23% from the second quarter of 2018. By comparison, 17 hedge funds held shares or bullish call options in WTM heading into this year. With hedge funds’ sentiment swirling, there exists a few notable hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Among these funds, Wallace Capital Management held the most valuable stake in White Mountains Insurance Group Ltd (NYSE:WTM), which was worth $77.2 million at the end of the third quarter. On the second spot was Third Avenue Management which amassed $26.8 million worth of shares. Moreover, Elkhorn Partners, Impax Asset Management, and Renaissance Technologies were also bullish on White Mountains Insurance Group Ltd (NYSE:WTM), allocating a large percentage of their portfolios to this stock.

Now, some big names have jumped into White Mountains Insurance Group Ltd (NYSE:WTM) headfirst. Impax Asset Management, managed by Ian Simm, created the largest position in White Mountains Insurance Group Ltd (NYSE:WTM). Impax Asset Management had $21.5 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also made a $0.3 million investment in the stock during the quarter. The following funds were also among the new WTM investors: D. E. Shaw’s D E Shaw and David Andre and Astro Teller’s Cerebellum Capital.

Let’s go over hedge fund activity in other stocks similar to White Mountains Insurance Group Ltd (NYSE:WTM). These stocks are KBR, Inc. (NYSE:KBR), Strayer Education Inc (NASDAQ:STRA), Houlihan Lokey Inc (NYSE:HLI), and Jagged Peak Energy Inc. (NYSE:JAG). This group of stocks’ market values match WTM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KBR | 19 | 490619 | -2 |

| STRA | 15 | 255963 | 3 |

| HLI | 14 | 205633 | -4 |

| JAG | 15 | 93556 | 5 |

| Average | 15.75 | 261443 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $261 million. That figure was $189 million in WTM’s case. KBR, Inc. (NYSE:KBR) is the most popular stock in this table. On the other hand Houlihan Lokey Inc (NYSE:HLI) is the least popular one with only 14 bullish hedge fund positions. White Mountains Insurance Group Ltd (NYSE:WTM) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KBR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.