The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Vail Resorts, Inc. (NYSE:MTN).

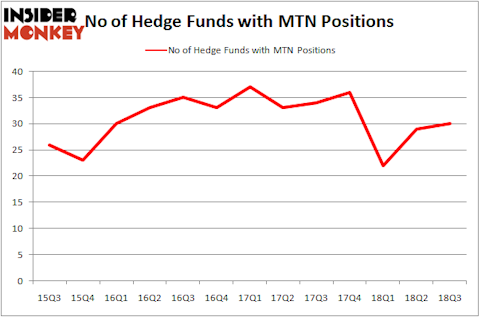

Vail Resorts, Inc. (NYSE:MTN) was in 30 hedge funds’ portfolios at the end of the third quarter of 2018. MTN investors should pay attention to an increase in support from the world’s most elite money managers of late. There were 29 hedge funds in our database with MTN positions at the end of the previous quarter. Our calculations also showed that MTN isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to analyze the recent hedge fund action surrounding Vail Resorts, Inc. (NYSE:MTN).

How are hedge funds trading Vail Resorts, Inc. (NYSE:MTN)?

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from one quarter earlier. On the other hand, there were a total of 36 hedge funds with a bullish position in MTN at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, SPO Advisory Corp held the most valuable stake in Vail Resorts, Inc. (NYSE:MTN), which was worth $264.5 million at the end of the third quarter. On the second spot was Renaissance Technologies which amassed $89.6 million worth of shares. Moreover, Diamond Hill Capital, Marshall Wace LLP, and Millennium Management were also bullish on Vail Resorts, Inc. (NYSE:MTN), allocating a large percentage of their portfolios to this stock.

Consequently, key money managers have jumped into Vail Resorts, Inc. (NYSE:MTN) headfirst. 1060 Capital Management, managed by Brian Gustavson and Andrew Haley, assembled the most valuable position in Vail Resorts, Inc. (NYSE:MTN). 1060 Capital Management had $26.1 million invested in the company at the end of the quarter. Jorge Paulo Lemann’s 3G Capital also made a $6.9 million investment in the stock during the quarter. The following funds were also among the new MTN investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Jeffrey Talpins’s Element Capital Management, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Vail Resorts, Inc. (NYSE:MTN) but similarly valued. These stocks are Brookfield Infrastructure Partners L.P. (NYSE:BIP), Burlington Stores Inc (NYSE:BURL), Campbell Soup Company (NYSE:CPB), and Extra Space Storage, Inc. (NYSE:EXR). This group of stocks’ market valuations are closest to MTN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BIP | 6 | 15818 | -2 |

| BURL | 35 | 972920 | 6 |

| CPB | 29 | 925852 | 3 |

| EXR | 22 | 292795 | 5 |

| Average | 23 | 551846 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $552 million. That figure was $808 million in MTN’s case. Burlington Stores Inc (NYSE:BURL) is the most popular stock in this table. On the other hand Brookfield Infrastructure Partners L.P. (NYSE:BIP) is the least popular one with only 6 bullish hedge fund positions. Vail Resorts, Inc. (NYSE:MTN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BURL might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.