The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards TerraForm Power Inc (NASDAQ:TERP).

Hedge fund interest in TerraForm Power Inc (NASDAQ:TERP) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Washington Real Estate Investment Trust (NYSE:WRE), WildHorse Resource Development Corporation (NYSE:WRD), and Advanced Disposal Services, Inc. (NYSE:ADSW) to gather more data points.

In the eyes of most stock holders, hedge funds are perceived as unimportant, old financial vehicles of the past. While there are over 8,000 funds trading at present, We hone in on the elite of this group, approximately 700 funds. These hedge fund managers orchestrate the lion’s share of all hedge funds’ total asset base, and by watching their matchless equity investments, Insider Monkey has identified several investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by 6 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a look at the fresh hedge fund action regarding TerraForm Power Inc (NASDAQ:TERP).

How are hedge funds trading TerraForm Power Inc (NASDAQ:TERP)?

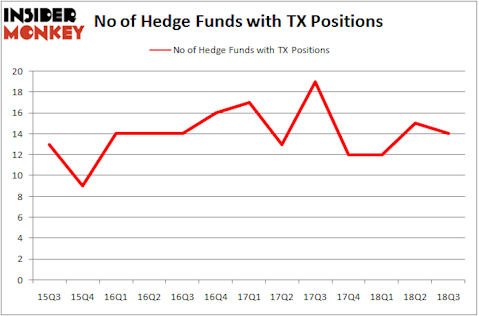

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, no change from the previous quarter. The graph below displays the number of hedge funds with bullish position in TERP over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Strategic Value Partners was the largest shareholder of TerraForm Power Inc (NASDAQ:TERP), with a stake worth $126.3 million reported as of the end of September. Trailing Strategic Value Partners was Appaloosa Management LP, which amassed a stake valued at $35.3 million. Highbridge Capital Management, Renaissance Technologies, and Ecofin Ltd were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as TerraForm Power Inc (NASDAQ:TERP) has faced bearish sentiment from the smart money, we can see that there lies a certain “tier” of money managers that elected to cut their entire stakes in the third quarter. At the top of the heap, John Overdeck and David Siegel’s Two Sigma Advisors dropped the biggest stake of the 700 funds monitored by Insider Monkey, comprising an estimated $1.2 million in stock, and Peter Muller’s PDT Partners was right behind this move, as the fund sold off about $0.8 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to TerraForm Power Inc (NASDAQ:TERP). These stocks are Washington Real Estate Investment Trust (NYSE:WRE), WildHorse Resource Development Corporation (NYSE:WRD), Advanced Disposal Services, Inc. (NYSE:ADSW), and AnaptysBio, Inc. (NASDAQ:ANAB). This group of stocks’ market values resemble TERP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WRE | 8 | 107809 | -1 |

| WRD | 20 | 99480 | -5 |

| ADSW | 12 | 182428 | -4 |

| ANAB | 22 | 950259 | 4 |

| Average | 15.5 | 334994 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.5 hedge funds with bullish positions and the average amount invested in these stocks was $335 million. That figure was $219 million in TERP’s case. AnaptysBio, Inc. (NASDAQ:ANAB) is the most popular stock in this table. On the other hand Washington Real Estate Investment Trust (NYSE:WRE) is the least popular one with only 8 bullish hedge fund positions. TerraForm Power Inc (NASDAQ:TERP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ANAB might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.