We can judge whether Teekay Corporation (NYSE:TK) is a good investment right now by following the lead of some of the best investors in the world and piggybacking their ideas. There’s no better way to get these firms’ immense resources and analytical capabilities working for us than to follow their lead into their best ideas. While not all of these picks will be winners, our research shows that these picks historically outperformed the market when we factor in known risk factors.

Is Teekay Corporation (NYSE:TK) a bargain? Investors who are in the know are turning bullish. The number of long hedge fund positions advanced by 3 in recent months. Our calculations also showed that TK isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. We’re going to analyze the latest hedge fund action encompassing Teekay Corporation (NYSE:TK).

How are hedge funds trading Teekay Corporation (NYSE:TK)?

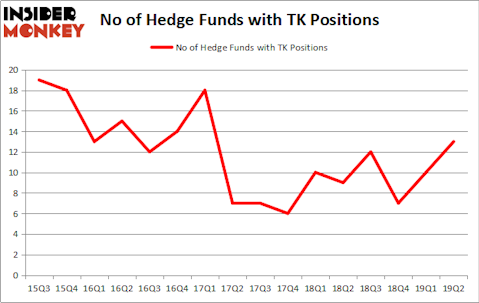

At the end of the second quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 30% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in TK over the last 16 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Teekay Corporation (NYSE:TK), which was worth $5.6 million at the end of the second quarter. On the second spot was Cobalt Capital Management which amassed $5.4 million worth of shares. Moreover, Orbis Investment Management, Dalton Investments, and Marshall Wace LLP were also bullish on Teekay Corporation (NYSE:TK), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, key money managers were leading the bulls’ herd. Cobalt Capital Management, managed by Wayne Cooperman, created the most valuable position in Teekay Corporation (NYSE:TK). Cobalt Capital Management had $5.4 million invested in the company at the end of the quarter. Paul Marshall and Ian Wace’s Marshall Wace LLP also made a $0.5 million investment in the stock during the quarter. The other funds with new positions in the stock are Peter Muller’s PDT Partners, Paul Tudor Jones’s Tudor Investment Corp, and D. E. Shaw’s D E Shaw.

Let’s go over hedge fund activity in other stocks similar to Teekay Corporation (NYSE:TK). These stocks are Standard Diversified Inc. (NYSE:SDI), SilverCrest Metals Inc. (NYSE:SILV), Calumet Specialty Products Partners, L.P (NASDAQ:CLMT), and Peoples Financial Services Corp. (NASDAQ:PFIS). All of these stocks’ market caps resemble TK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SDI | 4 | 7173 | 1 |

| SILV | 2 | 12572 | -1 |

| CLMT | 5 | 10355 | 1 |

| PFIS | 1 | 2541 | 0 |

| Average | 3 | 8160 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 3 hedge funds with bullish positions and the average amount invested in these stocks was $8 million. That figure was $19 million in TK’s case. Calumet Specialty Products Partners, L.P (NASDAQ:CLMT) is the most popular stock in this table. On the other hand Peoples Financial Services Corp. (NASDAQ:PFIS) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Teekay Corporation (NYSE:TK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on TK as the stock returned 16.3% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.