Based on the fact that hedge funds have collectively under-performed the market for several years, it would be easy to assume that their stock picks simply aren’t very good. However, our research shows this not to be the case. In fact, when it comes to their very top picks collectively, they show a strong ability to pick winning stocks. This year hedge funds’ top 30 stock picks easily bested the broader market, at 6.7% compared to 2.6%, despite there being a few duds in there like Facebook (even their collective wisdom isn’t perfect). The results show that there is plenty of merit to imitating the collective wisdom of top investors.

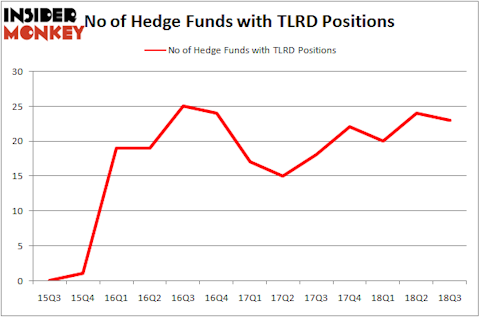

Tailored Brands, Inc. (NYSE:TLRD) has seen a decrease in hedge fund sentiment of late. TLRD was in 23 hedge funds’ portfolios at the end of September. There were 24 hedge funds in our database with TLRD holdings at the end of the previous quarter. Our calculations also showed that TLRD isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the new hedge fund action encompassing Tailored Brands, Inc. (NYSE:TLRD).

What have hedge funds been doing with Tailored Brands, Inc. (NYSE:TLRD)?

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -4% from one quarter earlier. On the other hand, there were a total of 22 hedge funds with a bullish position in TLRD at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Renaissance Technologies was the largest shareholder of Tailored Brands, Inc. (NYSE:TLRD), with a stake worth $22.5 million reported as of the end of September. Trailing Renaissance Technologies was Arrowstreet Capital, which amassed a stake valued at $20.9 million. Millennium Management, Gotham Asset Management, and Armistice Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Since Tailored Brands, Inc. (NYSE:TLRD) has witnessed bearish sentiment from hedge fund managers, it’s safe to say that there was a specific group of money managers that decided to sell off their entire stakes by the end of the third quarter. Intriguingly, Robert Bishop’s Impala Asset Management dropped the biggest investment of the 700 funds tracked by Insider Monkey, totaling about $17.6 million in call options. Alexander Mitchell’s fund, Scopus Asset Management, also dumped its call options, about $15.3 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to Tailored Brands, Inc. (NYSE:TLRD). These stocks are ArcBest Corp (NASDAQ:ARCB), Endocyte, Inc. (NASDAQ:ECYT), NeoGenomics, Inc. (NASDAQ:NEO), and PGT Innovations Inc. (NASDAQ:PGTI). This group of stocks’ market valuations are similar to TLRD’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ARCB | 14 | 77690 | -2 |

| ECYT | 27 | 540428 | 9 |

| NEO | 17 | 26803 | 4 |

| PGTI | 22 | 146257 | 2 |

| Average | 20 | 197795 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $198 million. That figure was $103 million in TLRD’s case. Endocyte, Inc. (NASDAQ:ECYT) is the most popular stock in this table. On the other hand ArcBest Corp (NASDAQ:ARCB) is the least popular one with only 14 bullish hedge fund positions. Tailored Brands, Inc. (NYSE:TLRD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ECYT might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.