“Since 2006, value stocks (IVE vs IVW) have underperformed 11 of the 13 calendar years and when they beat growth, it wasn’t by much. Cumulatively, through this week, it has been a 122% differential (up 52% for value vs up 174% for growth). This appears to be the longest and most severe drought for value investors since data collection began. It will go our way eventually as there are too many people paying far too much for today’s darlings, both public and private. Further, the ten-year yield of 2.5% (pre-tax) isn’t attractive nor is real estate. We believe the value part of the global equity market is the only place to earn solid risk adjusted returns and we believe those returns will be higher than normal,” said Vilas Fund in its Q1 investor letter. We aren’t sure whether value stocks outperform growth, but we follow hedge fund investor letters to understand where the markets and stocks might be going. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Standard Motor Products, Inc. (NYSE:SMP).

Standard Motor Products, Inc. (NYSE:SMP) was in 13 hedge funds’ portfolios at the end of the third quarter of 2019. SMP has experienced an increase in hedge fund interest in recent months. There were 11 hedge funds in our database with SMP positions at the end of the previous quarter. Our calculations also showed that SMP isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

According to most market participants, hedge funds are viewed as slow, outdated investment tools of yesteryear. While there are greater than 8000 funds trading at the moment, We hone in on the crème de la crème of this group, around 750 funds. These money managers shepherd most of the hedge fund industry’s total capital, and by following their matchless picks, Insider Monkey has found many investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship short hedge fund strategy exceeded the S&P 500 short ETFs by around 20 percentage points per annum since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Mario Gabelli of GAMCO Investors

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the new hedge fund action encompassing Standard Motor Products, Inc. (NYSE:SMP).

Hedge fund activity in Standard Motor Products, Inc. (NYSE:SMP)

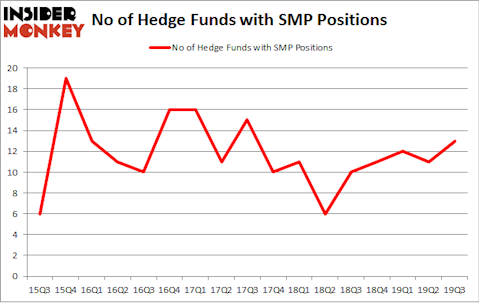

Heading into the fourth quarter of 2019, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 18% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in SMP over the last 17 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Standard Motor Products, Inc. (NYSE:SMP) was held by Royce & Associates, which reported holding $89.4 million worth of stock at the end of September. It was followed by GAMCO Investors with a $7.5 million position. Other investors bullish on the company included Renaissance Technologies, Citadel Investment Group, and Marshall Wace. In terms of the portfolio weights assigned to each position Royce & Associates allocated the biggest weight to Standard Motor Products, Inc. (NYSE:SMP), around 0.83% of its 13F portfolio. Zebra Capital Management is also relatively very bullish on the stock, designating 0.56 percent of its 13F equity portfolio to SMP.

As aggregate interest increased, some big names were breaking ground themselves. Marshall Wace, managed by Paul Marshall and Ian Wace, initiated the biggest position in Standard Motor Products, Inc. (NYSE:SMP). Marshall Wace had $1.8 million invested in the company at the end of the quarter. Donald Sussman’s Paloma Partners also made a $0.5 million investment in the stock during the quarter. The other funds with brand new SMP positions are Minhua Zhang’s Weld Capital Management and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Standard Motor Products, Inc. (NYSE:SMP) but similarly valued. These stocks are Natus Medical Incorporated (NASDAQ:NTUS), Kenon Holdings Ltd. (NYSE:KEN), Enviva Partners, LP (NYSE:EVA), and Qutoutiao Inc. (NASDAQ:QTT). This group of stocks’ market values resemble SMP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTUS | 21 | 82632 | -1 |

| KEN | 1 | 1950 | 0 |

| EVA | 4 | 92763 | -3 |

| QTT | 5 | 12863 | -2 |

| Average | 7.75 | 47552 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7.75 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $112 million in SMP’s case. Natus Medical Incorporated (NASDAQ:NTUS) is the most popular stock in this table. On the other hand Kenon Holdings Ltd. (NYSE:KEN) is the least popular one with only 1 bullish hedge fund positions. Standard Motor Products, Inc. (NYSE:SMP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately SMP wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on SMP were disappointed as the stock returned 4.2% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.