Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Reliance Steel & Aluminum (NYSE:RS) to find out whether it was one of their high conviction long-term ideas.

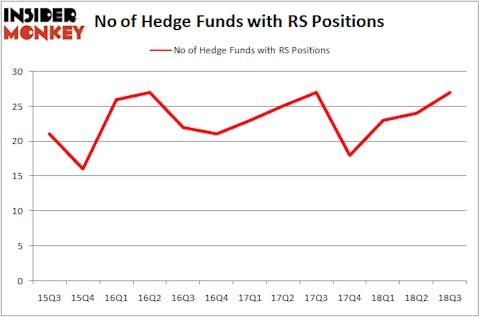

Is Reliance Steel & Aluminum Co. (NYSE:RS) going to take off soon? Hedge funds are betting on the stock. The number of long hedge fund positions advanced by 3 recently, and the company was in 27 hedge funds’ portfolios at the end of September. Although the company has been steadily building its network of shareholders, among them there weren’t many billionaires. (If you are interested to see which stock billionaires have been piling on, take a look at the list of 30 stocks billionaires are crazy about: Insider Monkey billionaires stock index.)

While collecting more data about Reliance Steel & Aluminum Co. (NYSE:RS) for the purpose of thorough analysis, we tracked down Poplar Forest Capital’s Quarterly Letter, in which this investment adviser shares its opinion on it. Here is that part of the letter:

“Reliance Steel (ticker: RS) is the largest metals service company in North America. It operates in a highly fragmented market with 2x to 3x the market share of its closest competitor. We view the company as the Berkshire Hathaway of the steel industry – it generates strong returns, allocates capital well and manages its business to take advantage of M&A opportunities in both good and bad market environments. In addition to steel price volatility, recent tariff and China concerns have dampened enthusiasm. However, we believe that at 10x 2019 consensus estimated earnings, Reliance is a well- run company offering above average return prospects while trading at a deep discount to the market.”

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a gander at the latest hedge fund action regarding Reliance Steel & Aluminum Co. (NYSE:RS).

How are hedge funds trading Reliance Steel & Aluminum Co. (NYSE:RS)?

At the end of the third quarter, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 13% from the second quarter of 2018. On the other hand, there were a total of 18 hedge funds with a bullish position in RS at the beginning of this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Luminus Management held the most valuable stake in Reliance Steel & Aluminum Co. (NYSE:RS), which was worth $97.8 million at the end of the third quarter. On the second spot was Royce & Associates which amassed $84.4 million worth of shares. Moreover, AQR Capital Management, Millennium Management, and D E Shaw were also bullish on Reliance Steel & Aluminum Co. (NYSE:RS), allocating a large percentage of their portfolios to this stock.

Now, key money managers were breaking ground themselves. Bailard Inc, managed by Thomas Bailard, created the largest position in Reliance Steel & Aluminum Co. (NYSE:RS). Bailard Inc had $3 million invested in the company at the end of the quarter. Peter Algert and Kevin Coldiron’s Algert Coldiron Investors also initiated a $1.3 million position during the quarter. The other funds with new positions in the stock are Brandon Haley’s Holocene Advisors, Matthew Hulsizer’s PEAK6 Capital Management, and Bruce Kovner’s Caxton Associates LP.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Reliance Steel & Aluminum Co. (NYSE:RS) but similarly valued. These stocks are Etsy Inc (NASDAQ:ETSY), Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR), Knight-Swift Transportation Holdings Inc. (NYSE:KNX), and Pure Storage, Inc. (NYSE:PSTG). All of these stocks’ market caps are similar to RS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ETSY | 32 | 924716 | 2 |

| ASR | 3 | 17929 | -1 |

| KNX | 31 | 411617 | -6 |

| PSTG | 31 | 666311 | 4 |

As you can see these stocks had an average of 24 hedge funds with bullish positions and the average amount invested in these stocks was $505 million. That figure was $374 million in RS’s case. Etsy Inc (NASDAQ:ETSY) is the most popular stock in this table. On the other hand Grupo Aeroportuario del Sureste, S. A. B. de C. V. (NYSE:ASR) is the least popular one with only 3 bullish hedge fund positions. Reliance Steel & Aluminum Co. (NYSE:RS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ETSY might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.