With the second-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the third quarter of 2021. One of these stocks was Public Storage (NYSE:PSA).

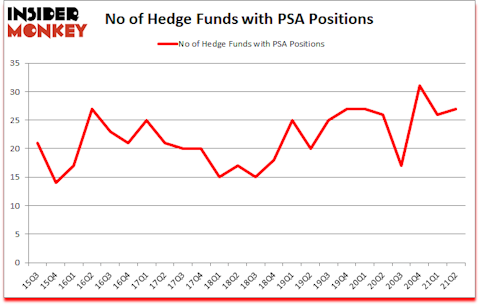

Is Public Storage (NYSE:PSA) ready to rally soon? Money managers were buying. The number of long hedge fund bets went up by 1 in recent months. Public Storage (NYSE:PSA) was in 27 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 31. Our calculations also showed that PSA isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

If you’d ask most stock holders, hedge funds are viewed as underperforming, old investment vehicles of the past. While there are greater than 8000 funds trading at present, Our researchers choose to focus on the top tier of this group, about 850 funds. It is estimated that this group of investors manage the lion’s share of the smart money’s total asset base, and by observing their top equity investments, Insider Monkey has figured out a few investment strategies that have historically exceeded the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points annually since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Paul Singer of Elliott Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to analyze the new hedge fund action encompassing Public Storage (NYSE:PSA).

Do Hedge Funds Think PSA Is A Good Stock To Buy Now?

At second quarter’s end, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 4% from the first quarter of 2020. Below, you can check out the change in hedge fund sentiment towards PSA over the last 24 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the number one position in Public Storage (NYSE:PSA), worth close to $284.2 million, comprising 1.1% of its total 13F portfolio. Coming in second is AQR Capital Management, managed by Cliff Asness, which holds a $181.1 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Remaining peers that hold long positions include Paul Singer’s Elliott Investment Management, Renaissance Technologies and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Land & Buildings Investment Management allocated the biggest weight to Public Storage (NYSE:PSA), around 6.41% of its 13F portfolio. Hill Winds Capital is also relatively very bullish on the stock, setting aside 4.07 percent of its 13F equity portfolio to PSA.

As aggregate interest increased, key money managers have been driving this bullishness. Capital Growth Management, managed by Ken Heebner, initiated the largest position in Public Storage (NYSE:PSA). Capital Growth Management had $28.6 million invested in the company at the end of the quarter. Ryan Tolkin (CIO)’s Schonfeld Strategic Advisors also initiated a $12.5 million position during the quarter. The other funds with new positions in the stock are Anand Parekh’s Alyeska Investment Group, Daniel Johnson’s Gillson Capital, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Public Storage (NYSE:PSA) but similarly valued. These stocks are Metlife Inc (NYSE:MET), Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), Biogen Inc. (NASDAQ:BIIB), Carvana Co. (NYSE:CVNA), ING Groep N.V. (NYSE:ING), UBS Group AG (NYSE:UBS), and Relx PLC (NYSE:RELX). This group of stocks’ market valuations resemble PSA’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MET | 41 | 1056766 | 9 |

| VRTX | 60 | 2808847 | -8 |

| BIIB | 67 | 3116691 | 4 |

| CVNA | 63 | 8904829 | -1 |

| ING | 9 | 601603 | -1 |

| UBS | 15 | 176356 | -1 |

| RELX | 6 | 58838 | 2 |

| Average | 37.3 | 2389133 | 0.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 37.3 hedge funds with bullish positions and the average amount invested in these stocks was $2389 million. That figure was $1090 million in PSA’s case. Biogen Inc. (NASDAQ:BIIB) is the most popular stock in this table. On the other hand Relx PLC (NYSE:RELX) is the least popular one with only 6 bullish hedge fund positions. Public Storage (NYSE:PSA) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for PSA is 49.3. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24.9% in 2021 through October 15th and still beat the market by 4.5 percentage points. A small number of hedge funds were also right about betting on PSA as the stock returned 6.9% since the end of the second quarter (through 10/15) and outperformed the market by an even larger margin.

Follow Public Storage (NYSE:PSA)

Follow Public Storage (NYSE:PSA)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Stocks To Buy For 2021

- 10 Best Alternative Fuel Stocks to Buy Now

- 10 Best Airline Stocks To Buy For 2021

Disclosure: None. This article was originally published at Insider Monkey.