Before we spend countless hours researching a company, we like to analyze what insiders, hedge funds and billionaire investors think of the stock first. This is a necessary first step in our investment process because our research has shown that the elite investors’ consensus returns have been exceptional. In the following paragraphs, we find out what the billionaire investors and hedge funds think of Owens Corning (NYSE:OC).

Owens Corning (NYSE:OC) has seen an increase in hedge fund interest in recent months. OC was in 34 hedge funds’ portfolios at the end of June. There were 27 hedge funds in our database with OC holdings at the end of the previous quarter. Our calculations also showed that OC isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the latest hedge fund action regarding Owens Corning (NYSE:OC).

How are hedge funds trading Owens Corning (NYSE:OC)?

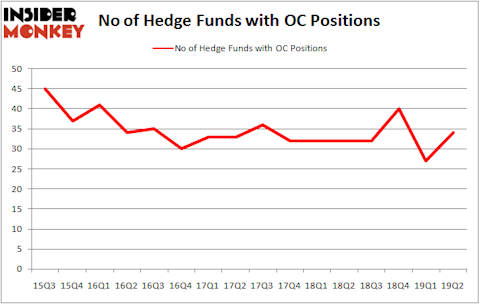

Heading into the third quarter of 2019, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 26% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in OC over the last 16 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Parag Vora’s HG Vora Capital Management has the most valuable position in Owens Corning (NYSE:OC), worth close to $221.2 million, comprising 16.1% of its total 13F portfolio. Sitting at the No. 2 spot is Maverick Capital, managed by Lee Ainslie, which holds a $204.1 million position; the fund has 3% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions contain John Khoury’s Long Pond Capital, Daniel Sundheim’s D1 Capital Partners and Ken Griffin’s Citadel Investment Group.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. HG Vora Capital Management, managed by Parag Vora, established the biggest position in Owens Corning (NYSE:OC). HG Vora Capital Management had $221.2 million invested in the company at the end of the quarter. Kerr Neilson’s Platinum Asset Management also initiated a $91.9 million position during the quarter. The following funds were also among the new OC investors: Benjamin Pass’s TOMS Capital, David Rosen’s Rubric Capital Management, and Eduardo Abush’s Waterfront Capital Partners.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Owens Corning (NYSE:OC) but similarly valued. These stocks are Dr. Reddy’s Laboratories Limited (NYSE:RDY), Gentex Corporation (NASDAQ:GNTX), Phillips 66 Partners LP (NYSE:PSXP), and Morningstar, Inc. (NASDAQ:MORN). All of these stocks’ market caps are closest to OC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RDY | 11 | 80625 | 0 |

| GNTX | 23 | 388264 | 0 |

| PSXP | 3 | 9904 | -1 |

| MORN | 20 | 265985 | -1 |

| Average | 14.25 | 186195 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14.25 hedge funds with bullish positions and the average amount invested in these stocks was $186 million. That figure was $1483 million in OC’s case. Gentex Corporation (NASDAQ:GNTX) is the most popular stock in this table. On the other hand Phillips 66 Partners LP (NYSE:PSXP) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Owens Corning (NYSE:OC) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on OC as the stock returned 9% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.