The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Newmont Mining Corp (NYSE:NEM) and find out how it is affected by hedge funds’ moves.

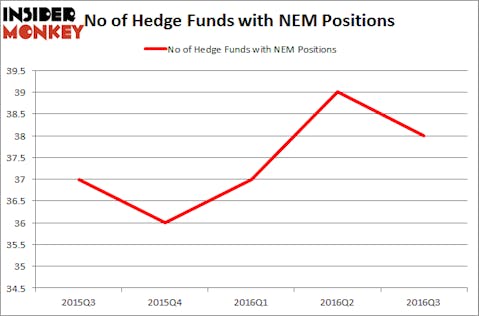

Newmont Mining Corp (NYSE:NEM) was in 38 hedge funds’ portfolios at the end of the third quarter of 2016. NEM has seen a decrease in hedge fund interest of late. There were 39 hedge funds in our database with NEM holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Illumina, Inc. (NASDAQ:ILMN), Wisconsin Energy Corporation (NYSE:WEC), and SunTrust Banks, Inc. (NYSE:STI) to gather more data points.

Follow Newmont Corp (NYSE:NEM)

Follow Newmont Corp (NYSE:NEM)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Copyright: tomas1111 / 123RF Stock Photo

With all of this in mind, we’re going to go over the key action encompassing Newmont Mining Corp (NYSE:NEM).

How are hedge funds trading Newmont Mining Corp (NYSE:NEM)?

At Q3’s end, a total of 38 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 3% from the second quarter of 2016. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Cliff Asness’s AQR Capital Management has the most valuable position in Newmont Mining Corp (NYSE:NEM), worth close to $117.3 million, corresponding to 0.2% of its total 13F portfolio. Coming in second is Millennium Management, led by Israel Englander, holding a $68 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism contain Robert Polak’s Anchor Bolt Capital, Robert Bishop’s Impala Asset Management and Mario Gabelli’s GAMCO Investors.