Insider Monkey has processed numerous 13F filings of hedge funds and famous investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and investors’ positions as of the end of the fourth quarter. You can find write-ups about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves and analyze what the smart money thinks of MGM Growth Properties LLC (NYSE:MGP) based on that data.

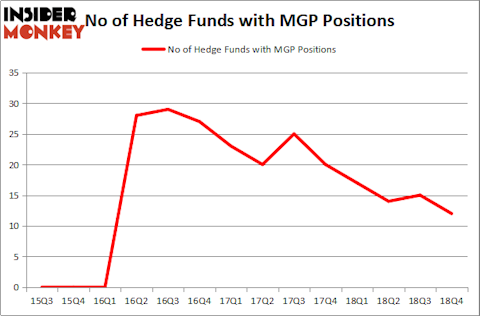

Is MGM Growth Properties LLC (NYSE:MGP) a healthy stock for your portfolio? The best stock pickers are becoming less hopeful. The number of long hedge fund bets went down by 3 recently. Our calculations also showed that MGP isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s view the key hedge fund action encompassing MGM Growth Properties LLC (NYSE:MGP).

What have hedge funds been doing with MGM Growth Properties LLC (NYSE:MGP)?

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in MGP over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Among these funds, Capital Growth Management held the most valuable stake in MGM Growth Properties LLC (NYSE:MGP), which was worth $35 million at the end of the third quarter. On the second spot was Echo Street Capital Management which amassed $32.6 million worth of shares. Moreover, Citadel Investment Group, Millennium Management, and Renaissance Technologies were also bullish on MGM Growth Properties LLC (NYSE:MGP), allocating a large percentage of their portfolios to this stock.

Seeing as MGM Growth Properties LLC (NYSE:MGP) has faced bearish sentiment from the aggregate hedge fund industry, we can see that there is a sect of fund managers who sold off their positions entirely heading into Q3. Interestingly, Joshua Kaufman and Craig Nerenberg’s Brenner West Capital Partners sold off the largest investment of the “upper crust” of funds followed by Insider Monkey, valued at close to $37 million in stock, and Jeffrey Gates’s Gates Capital Management was right behind this move, as the fund dumped about $20.3 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 3 funds heading into Q3.

Let’s check out hedge fund activity in other stocks similar to MGM Growth Properties LLC (NYSE:MGP). We will take a look at Liberty Media Corporation (NASDAQ:FWONA), KT Corporation (NYSE:KT), Erie Indemnity Company (NASDAQ:ERIE), and GrubHub Inc (NYSE:GRUB). This group of stocks’ market valuations resemble MGP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FWONA | 19 | 271792 | -2 |

| KT | 16 | 271168 | 7 |

| ERIE | 11 | 71198 | -3 |

| GRUB | 23 | 860282 | -15 |

| Average | 17.25 | 368610 | -3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.25 hedge funds with bullish positions and the average amount invested in these stocks was $369 million. That figure was $152 million in MGP’s case. GrubHub Inc (NYSE:GRUB) is the most popular stock in this table. On the other hand Erie Indemnity Company (NASDAQ:ERIE) is the least popular one with only 11 bullish hedge fund positions. MGM Growth Properties LLC (NYSE:MGP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. A few hedge funds were also right about betting on MGP as the stock returned 24.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.