“The global economic environment is very favorable for investors. Economies are generally strong, but not too strong. Employment levels are among the strongest for many decades. Interest rates are paused at very low levels, and the risk of significant increases in the medium term seems low. Financing for transactions is freely available to good borrowers, but not in major excess. Covenants are lighter than they were five years ago, but the extreme excesses seen in the past do not seem prevalent yet today. Despite this apparent ‘goldilocks’ market environment, we continue to worry about a world where politics are polarized almost everywhere, interest rates are low globally, and equity valuations are at their peak,” are the words of Brookfield Asset Management. Brookfield was right about politics as stocks experienced their second worst May since the 1960s due to escalation of trade disputes. We pay attention to what hedge funds are doing in a particular stock before considering a potential investment because it works for us. So let’s take a glance at the smart money sentiment towards Lam Research Corporation (NASDAQ:LRCX) and see how it was affected.

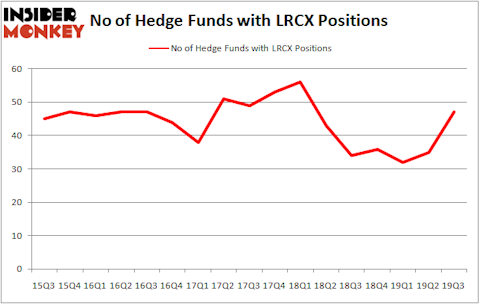

Is Lam Research Corporation (NASDAQ:LRCX) a safe stock to buy now? The best stock pickers are buying. The number of long hedge fund bets went up by 12 recently. Our calculations also showed that LRCX isn’t among the 30 most popular stocks among hedge funds. LRCX was in 47 hedge funds’ portfolios at the end of the third quarter of 2019. There were 35 hedge funds in our database with LRCX positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the Russell 2000 ETFs by 40 percentage points since May 2014 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.8% through November 21, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Paul Marshall of Marshall Wace

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let’s analyze the latest hedge fund action encompassing Lam Research Corporation (NASDAQ:LRCX).

How are hedge funds trading Lam Research Corporation (NASDAQ:LRCX)?

At Q3’s end, a total of 47 of the hedge funds tracked by Insider Monkey were long this stock, a change of 34% from the second quarter of 2019. On the other hand, there were a total of 34 hedge funds with a bullish position in LRCX a year ago. With hedgies’ capital changing hands, there exists a select group of noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Cliff Asness’s AQR Capital Management has the largest position in Lam Research Corporation (NASDAQ:LRCX), worth close to $406.5 million, corresponding to 0.5% of its total 13F portfolio. Coming in second is Two Sigma Advisors, led by John Overdeck and David Siegel, holding a $207 million position; 0.5% of its 13F portfolio is allocated to the company. Some other members of the smart money with similar optimism consist of Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Alex Snow’s Lansdowne Partners and Panayotis Takis Sparaggis’s Alkeon Capital Management. In terms of the portfolio weights assigned to each position Marlowe Partners allocated the biggest weight to Lam Research Corporation (NASDAQ:LRCX), around 9.4% of its portfolio. RGM Capital is also relatively very bullish on the stock, dishing out 6.81 percent of its 13F equity portfolio to LRCX.

Consequently, specific money managers were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the largest position in Lam Research Corporation (NASDAQ:LRCX). Arrowstreet Capital had $194.5 million invested in the company at the end of the quarter. Dmitry Balyasny’s Balyasny Asset Management also initiated a $48.2 million position during the quarter. The following funds were also among the new LRCX investors: Steve Cohen’s Point72 Asset Management, Brandon Haley’s Holocene Advisors, and Paul Marshall and Ian Wace’s Marshall Wace.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Lam Research Corporation (NASDAQ:LRCX) but similarly valued. We will take a look at General Mills, Inc. (NYSE:GIS), Cognizant Technology Solutions Corp (NASDAQ:CTSH), eBay Inc (NASDAQ:EBAY), and The Hershey Company (NYSE:HSY). All of these stocks’ market caps resemble LRCX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GIS | 35 | 916081 | -4 |

| CTSH | 40 | 2368649 | 7 |

| EBAY | 53 | 3488246 | 6 |

| HSY | 33 | 1103825 | 6 |

| Average | 40.25 | 1969200 | 3.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40.25 hedge funds with bullish positions and the average amount invested in these stocks was $1969 million. That figure was $2130 million in LRCX’s case. eBay Inc (NASDAQ:EBAY) is the most popular stock in this table. On the other hand The Hershey Company (NYSE:HSY) is the least popular one with only 33 bullish hedge fund positions. Lam Research Corporation (NASDAQ:LRCX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Hedge funds were also right about betting on LRCX as the stock returned 13.4% during the fourth quarter (through 11/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.