Out of thousands of stocks that are currently traded on the market, it is difficult to determine those that can really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of over 700 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Integra Lifesciences Holdings Corp (NASDAQ:IART).

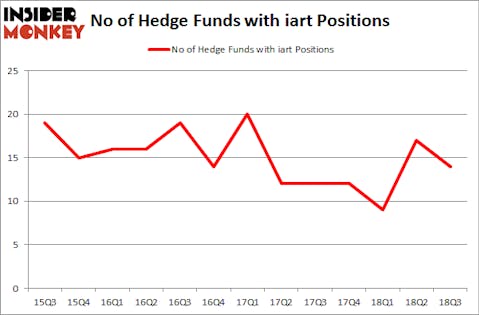

Integra Lifesciences Holdings Corp (NASDAQ:IART) has experienced a decrease in support from the world’s most elite money managers in recent months. IART was in 14 hedge funds’ portfolios at the end of the third quarter of 2018. There were 17 hedge funds in our database with IART positions at the end of the previous quarter. Our calculations also showed that iart isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the new hedge fund action regarding Integra Lifesciences Holdings Corp (NASDAQ:IART).

How have hedgies been trading Integra Lifesciences Holdings Corp (NASDAQ:IART)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -18% from the previous quarter. The graph below displays the number of hedge funds with bullish position in IART over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Fisher Asset Management was the largest shareholder of Integra Lifesciences Holdings Corp (NASDAQ:IART), with a stake worth $61.9 million reported as of the end of September. Trailing Fisher Asset Management was D E Shaw, which amassed a stake valued at $29.8 million. Millennium Management, Renaissance Technologies, and Adage Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Since Integra Lifesciences Holdings Corp (NASDAQ:IART) has faced bearish sentiment from the aggregate hedge fund industry, logic holds that there were a few fund managers that decided to sell off their full holdings last quarter. Interestingly, John W. Rende’s Copernicus Capital Management cut the largest position of all the hedgies followed by Insider Monkey, totaling about $4.1 million in stock. Benjamin A. Smith’s fund, Laurion Capital Management, also said goodbye to its stock, about $1.5 million worth. These transactions are interesting, as total hedge fund interest fell by 3 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Integra Lifesciences Holdings Corp (NASDAQ:IART). We will take a look at Wix.Com Ltd (NASDAQ:WIX), Globus Medical Inc (NYSE:GMED), Manpowergroup Inc (NYSE:MAN), and United Therapeutics Corporation (NASDAQ:UTHR). This group of stocks’ market valuations are closest to IART’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WIX | 24 | 933542 | -3 |

| GMED | 19 | 318800 | 5 |

| MAN | 28 | 591849 | -2 |

| UTHR | 18 | 1006633 | -3 |

| Average | 22.25 | 712706 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $713 million. That figure was $189 million in IART’s case. Manpowergroup Inc (NYSE:MAN) is the most popular stock in this table. On the other hand United Therapeutics Corporation (NASDAQ:UTHR) is the least popular one with only 18 bullish hedge fund positions. Compared to these stocks Integra Lifesciences Holdings Corp (NASDAQ:IART) is even less popular than UTHR. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.