Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Globus Medical Inc (NYSE:GMED).

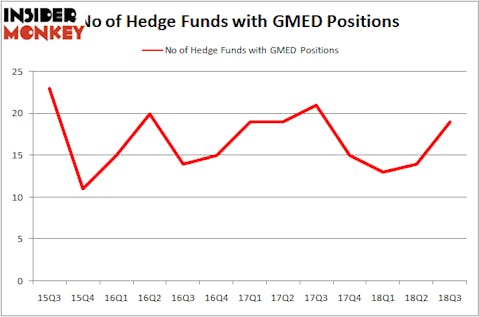

Is Globus Medical Inc (NYSE:GMED) a bargain? The best stock pickers are betting on the stock. The number of long hedge fund positions went up by 5 recently. Our calculations also showed that GMED isn’t among the 30 most popular stocks among hedge funds. GMED was in 19 hedge funds’ portfolios at the end of the third quarter of 2018. There were 14 hedge funds in our database with GMED holdings at the end of the previous quarter.

Today there are tons of formulas shareholders employ to value their stock investments. Two of the most under-the-radar formulas are hedge fund and insider trading sentiment. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outperform their index-focused peers by a healthy amount (see the details here).

We’re going to take a glance at the key hedge fund action encompassing Globus Medical Inc (NYSE:GMED).

What have hedge funds been doing with Globus Medical Inc (NYSE:GMED)?

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 36% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards GMED over the last 13 quarters. With hedge funds’ capital changing hands, there exists a few key hedge fund managers who were boosting their holdings considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cliff Asness’s AQR Capital Management has the number one position in Globus Medical Inc (NYSE:GMED), worth close to $112.3 million, amounting to 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Renaissance Technologies, led by Jim Simons, holding a $50.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other peers that are bullish consist of Paul Marshall and Ian Wace’s Marshall Wace LLP, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Noam Gottesman’s GLG Partners.

As aggregate interest increased, key hedge funds were breaking ground themselves. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, initiated the most outsized position in Globus Medical Inc (NYSE:GMED). Marshall Wace LLP had $48.9 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $4.3 million investment in the stock during the quarter. The following funds were also among the new GMED investors: Phill Gross and Robert Atchinson’s Adage Capital Management, Matthew Hulsizer’s PEAK6 Capital Management, and Bruce Kovner’s Caxton Associates LP.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Globus Medical Inc (NYSE:GMED) but similarly valued. We will take a look at Manpowergroup Inc (NYSE:MAN), United Therapeutics Corporation (NASDAQ:UTHR), GCI Liberty, Inc. (NASDAQ:GLIBA), and Envision Healthcare Holdings Inc (NYSE:EVHC). This group of stocks’ market valuations are similar to GMED’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAN | 28 | 591849 | -2 |

| UTHR | 18 | 1006633 | -3 |

| GLIBA | 36 | 1640542 | 0 |

| EVHC | 35 | 1409277 | -3 |

| Average | 29.25 | 1162075 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.16 billion. That figure was $319 million in GMED’s case. GCI Liberty, Inc. (NASDAQ:GLIBA) is the most popular stock in this table. On the other hand United Therapeutics Corporation (NASDAQ:UTHR) is the least popular one with only 18 bullish hedge fund positions. Globus Medical Inc (NYSE:GMED) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard GLIBA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.