While the market driven by short-term sentiment influenced by the accommodative interest rate environment in the US, virus news and stimulus spending, many smart money investors are starting to get cautious towards the current bull run since March, 2020 and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Focus Financial Partners Inc. (NASDAQ:FOCS).

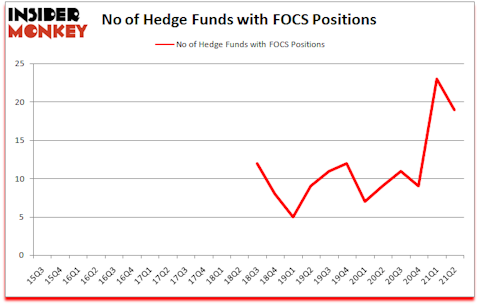

Focus Financial Partners Inc. (NASDAQ:FOCS) investors should be aware of a decrease in hedge fund interest lately. Focus Financial Partners Inc. (NASDAQ:FOCS) was in 19 hedge funds’ portfolios at the end of June. The all time high for this statistic is 23. There were 23 hedge funds in our database with FOCS holdings at the end of March. Our calculations also showed that FOCS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Hedge funds have more than $3.5 trillion in assets under management, so you can’t expect their entire portfolios to beat the market by large margins. Our research was able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 79 percentage points since March 2017 (see the details here). So you can still find a lot of gems by following hedge funds’ moves today.

Jeffrey Talpins of Element Capital

Keeping this in mind we’re going to take a peek at the new hedge fund action regarding Focus Financial Partners Inc. (NASDAQ:FOCS).

Do Hedge Funds Think FOCS Is A Good Stock To Buy Now?

At Q2’s end, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -17% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards FOCS over the last 24 quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

Among these funds, Soros Fund Management held the most valuable stake in Focus Financial Partners Inc. (NASDAQ:FOCS), which was worth $37.1 million at the end of the second quarter. On the second spot was Millennium Management which amassed $26.7 million worth of shares. Azora Capital, CaaS Capital, and Element Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Azora Capital allocated the biggest weight to Focus Financial Partners Inc. (NASDAQ:FOCS), around 3.57% of its 13F portfolio. Element Capital Management is also relatively very bullish on the stock, earmarking 2.24 percent of its 13F equity portfolio to FOCS.

Judging by the fact that Focus Financial Partners Inc. (NASDAQ:FOCS) has faced a decline in interest from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of fund managers that elected to cut their positions entirely heading into Q3. Interestingly, Daniel Johnson’s Gillson Capital dumped the largest investment of all the hedgies monitored by Insider Monkey, totaling an estimated $8.4 million in stock, and Paul Marshall and Ian Wace’s Marshall Wace LLP was right behind this move, as the fund dumped about $7.6 million worth. These moves are interesting, as aggregate hedge fund interest fell by 4 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Focus Financial Partners Inc. (NASDAQ:FOCS) but similarly valued. These stocks are Mantech International Corp (NASDAQ:MANT), WD-40 Company (NASDAQ:WDFC), Lexington Realty Trust (NYSE:LXP), NuVasive, Inc. (NASDAQ:NUVA), Outfront Media Inc. (REIT) (NYSE:OUT), The Simply Good Foods Company (NASDAQ:SMPL), and Insperity Inc (NYSE:NSP). This group of stocks’ market caps resemble FOCS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MANT | 12 | 22720 | -2 |

| WDFC | 17 | 150576 | 3 |

| LXP | 16 | 104285 | 4 |

| NUVA | 23 | 287292 | 3 |

| OUT | 31 | 701645 | -10 |

| SMPL | 17 | 212669 | -5 |

| NSP | 20 | 220013 | 0 |

| Average | 19.4 | 242743 | -1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.4 hedge funds with bullish positions and the average amount invested in these stocks was $243 million. That figure was $168 million in FOCS’s case. Outfront Media Inc. (REIT) (NYSE:OUT) is the most popular stock in this table. On the other hand Mantech International Corp (NASDAQ:MANT) is the least popular one with only 12 bullish hedge fund positions. Focus Financial Partners Inc. (NASDAQ:FOCS) is not the least popular stock in this group but hedge fund interest is still below average. Our overall hedge fund sentiment score for FOCS is 44.2. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. A small number of hedge funds were also right about betting on FOCS as the stock returned 26.8% since the end of the second quarter (through 10/22) and outperformed the market by an even larger margin.

Follow Focus Financial Partners Inc. (NASDAQ:FOCS)

Follow Focus Financial Partners Inc. (NASDAQ:FOCS)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Shipping Stocks that Pay Dividends

- 15 Largest Beverage Companies by Market Cap

- 15 Fastest Growing Developing Countries in 2020

Disclosure: None. This article was originally published at Insider Monkey.