While the market driven by short-term sentiment influenced by uncertainty regarding the future of the interest rate environment in the US, declining oil prices and the trade war with China, many smart money investors are keeping their optimism regarding the current bull run, while still hedging many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Fidelity National Financial Inc (NYSE:FNF).

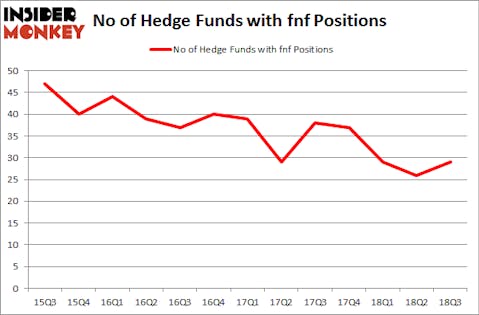

Fidelity National Financial Inc (NYSE:FNF) investors should be aware of an increase in hedge fund interest recently. FNF was in 29 hedge funds’ portfolios at the end of the third quarter of 2018. There were 26 hedge funds in our database with FNF holdings at the end of the previous quarter. Our calculations also showed that fnf isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are assumed to be worthless, outdated investment vehicles of the past. While there are more than 8,000 funds in operation today, Our experts choose to focus on the bigwigs of this group, approximately 700 funds. It is estimated that this group of investors watch over the majority of the hedge fund industry’s total capital, and by paying attention to their top equity investments, Insider Monkey has figured out a number of investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outrun the S&P 500 index by 6 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a peek at the recent hedge fund action surrounding Fidelity National Financial Inc (NYSE:FNF).

How are hedge funds trading Fidelity National Financial Inc (NYSE:FNF)?

Heading into the fourth quarter of 2018, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of 12% from the previous quarter. On the other hand, there were a total of 37 hedge funds with a bullish position in FNF at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Fidelity National Financial Inc (NYSE:FNF) was held by AQR Capital Management, which reported holding $253 million worth of stock at the end of September. It was followed by D E Shaw with a $59.8 million position. Other investors bullish on the company included Marshall Wace LLP, Renaissance Technologies, and Third Avenue Management.

Now, key hedge funds were breaking ground themselves. GLG Partners, managed by Noam Gottesman, assembled the most outsized position in Fidelity National Financial Inc (NYSE:FNF). GLG Partners had $8.3 million invested in the company at the end of the quarter. Israel Englander’s Millennium Management also made a $6.1 million investment in the stock during the quarter. The following funds were also among the new FNF investors: Matthew Hulsizer’s PEAK6 Capital Management, Paul Tudor Jones’s Tudor Investment Corp, and Roger Ibbotson’s Zebra Capital Management.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Fidelity National Financial Inc (NYSE:FNF) but similarly valued. We will take a look at UDR, Inc. (NYSE:UDR), Dropbox, Inc. (NASDAQ:DBX), Yandex NV (NASDAQ:YNDX), and Westlake Chemical Corporation (NYSE:WLK). This group of stocks’ market values are closest to FNF’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UDR | 16 | 446632 | -1 |

| DBX | 27 | 461569 | 0 |

| YNDX | 37 | 984529 | -1 |

| WLK | 19 | 326824 | -5 |

| Average | 24.75 | 554889 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.75 hedge funds with bullish positions and the average amount invested in these stocks was $555 million. That figure was $492 million in FNF’s case. Yandex NV (NASDAQ:YNDX) is the most popular stock in this table. On the other hand UDR, Inc. (NYSE:UDR) is the least popular one with only 16 bullish hedge fund positions. Fidelity National Financial Inc (NYSE:FNF) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard YNDX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.