Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The fourth quarter of 2018 is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of EQT Midstream Partners LP (NYSE:EQM).

Hedge fund interest in EQT Midstream Partners LP (NYSE:EQM) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare EQM to other stocks including Watsco Inc (NYSE:WSO), Companhia Energetica Minas Gerais (NYSE:CIG), and James Hardie Industries plc (NYSE:JHX) to get a better sense of its popularity.

In the 21st century investor’s toolkit there are several signals investors have at their disposal to size up stocks. A duo of the most useful signals are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the top picks of the best money managers can outclass the S&P 500 by a healthy margin (see the details here).

Let’s go over the latest hedge fund action encompassing EQT Midstream Partners LP (NYSE:EQM).

How are hedge funds trading EQT Midstream Partners LP (NYSE:EQM)?

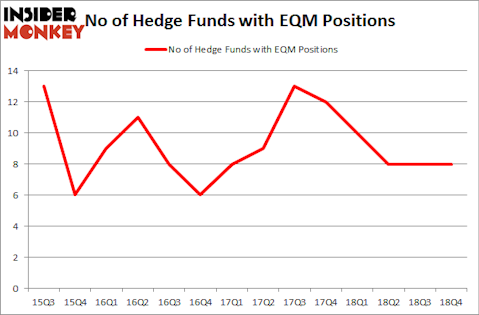

At the end of the fourth quarter, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards EQM over the last 14 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Zimmer Partners was the largest shareholder of EQT Midstream Partners LP (NYSE:EQM), with a stake worth $42 million reported as of the end of September. Trailing Zimmer Partners was PEAK6 Capital Management, which amassed a stake valued at $11.1 million. Driehaus Capital, Soros Fund Management, and Birchview Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that EQT Midstream Partners LP (NYSE:EQM) has experienced a decline in interest from the aggregate hedge fund industry, it’s safe to say that there was a specific group of hedgies that decided to sell off their full holdings in the third quarter. It’s worth mentioning that T Boone Pickens’s BP Capital said goodbye to the largest investment of the 700 funds monitored by Insider Monkey, totaling about $5.3 million in stock, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund dropped about $4.6 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to EQT Midstream Partners LP (NYSE:EQM). We will take a look at Watsco Inc (NYSE:WSO), Companhia Energetica de Minas Gerais (NYSE:CIG), James Hardie Industries plc (NYSE:JHX), and Logitech International S.A. (NASDAQ:LOGI). All of these stocks’ market caps are closest to EQM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WSO | 14 | 134848 | -3 |

| CIG | 7 | 13598 | 1 |

| JHX | 2 | 3804 | 0 |

| LOGI | 14 | 160893 | -5 |

| Average | 9.25 | 78286 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 9.25 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $54 million in EQM’s case. Watsco Inc (NYSE:WSO) is the most popular stock in this table. On the other hand James Hardie Industries plc (NYSE:JHX) is the least popular one with only 2 bullish hedge fund positions. EQT Midstream Partners LP (NYSE:EQM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately EQM wasn’t in this group. Hedge funds that bet on EQM were disappointed as the stock returned 9.5% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.