The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded CGI Group Inc. (NYSE:GIB) based on those filings.

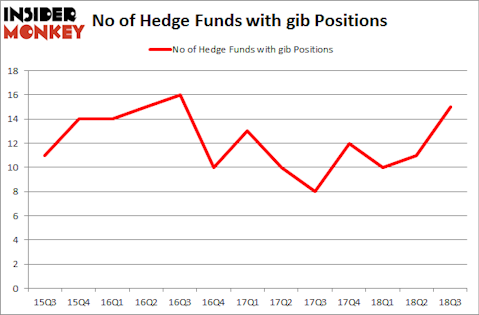

Is CGI Group Inc. (NYSE:GIB) ready to rally soon? Hedge funds are taking an optimistic view. The number of long hedge fund bets rose by 4 in recent months. Our calculations also showed that gib isn’t among the 30 most popular stocks among hedge funds. GIB was in 15 hedge funds’ portfolios at the end of the third quarter of 2018. There were 11 hedge funds in our database with GIB positions at the end of the previous quarter.

At the moment there are a lot of metrics stock traders have at their disposal to analyze stocks. Some of the most underrated metrics are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the top money managers can outpace the S&P 500 by a superb margin (see the details here).

We’re going to take a peek at the recent hedge fund action encompassing CGI Group Inc. (NYSE:GIB).

How are hedge funds trading CGI Group Inc. (NYSE:GIB)?

At the end of the third quarter, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 36% from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in GIB heading into this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in CGI Group Inc. (NYSE:GIB) was held by AQR Capital Management, which reported holding $101.7 million worth of stock at the end of September. It was followed by GLG Partners with a $85.2 million position. Other investors bullish on the company included Arrowstreet Capital, Two Sigma Advisors, and Gotham Asset Management.

With a general bullishness amongst the heavyweights, key money managers have jumped into CGI Group Inc. (NYSE:GIB) headfirst. Echo Street Capital Management, managed by Greg Poole, assembled the most outsized position in CGI Group Inc. (NYSE:GIB). Echo Street Capital Management had $10.5 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $1.5 million investment in the stock during the quarter. The other funds with brand new GIB positions are Jim Simons’s Renaissance Technologies, Alec Litowitz and Ross Laser’s Magnetar Capital, and George Zweig, Shane Haas and Ravi Chander’s Signition LP.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as CGI Group Inc. (NYSE:GIB) but similarly valued. These stocks are Newmont Mining Corp (NYSE:NEM), Franklin Resources, Inc. (NYSE:BEN), Match Group, Inc. (NASDAQ:MTCH), and WellCare Health Plans, Inc. (NYSE:WCG). This group of stocks’ market caps match GIB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NEM | 26 | 447709 | -2 |

| BEN | 29 | 878291 | -4 |

| MTCH | 29 | 937712 | 3 |

| WCG | 35 | 1713127 | 5 |

| Average | 29.75 | 994210 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.75 hedge funds with bullish positions and the average amount invested in these stocks was $994 million. That figure was $306 million in GIB’s case. WellCare Health Plans, Inc. (NYSE:WCG) is the most popular stock in this table. On the other hand Newmont Mining Corp (NYSE:NEM) is the least popular one with only 26 bullish hedge fund positions. Compared to these stocks CGI Group Inc. (NYSE:GIB) is even less popular than NEM. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.