Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Carnival plc (NYSE:CUK) from the perspective of those elite funds.

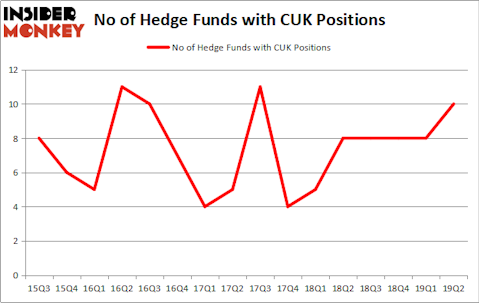

Carnival plc (NYSE:CUK) was in 10 hedge funds’ portfolios at the end of June. CUK investors should be aware of an increase in activity from the world’s largest hedge funds recently. There were 8 hedge funds in our database with CUK holdings at the end of the previous quarter. Our calculations also showed that CUK isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the new hedge fund action encompassing Carnival plc (NYSE:CUK).

How are hedge funds trading Carnival plc (NYSE:CUK)?

At the end of the second quarter, a total of 10 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 25% from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in CUK a year ago. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

The largest stake in Carnival plc (NYSE:CUK) was held by Renaissance Technologies, which reported holding $36.5 million worth of stock at the end of March. It was followed by Arrowstreet Capital with a $33.3 million position. Other investors bullish on the company included Marshall Wace LLP, Citadel Investment Group, and Two Sigma Advisors.

Now, specific money managers were breaking ground themselves. Citadel Investment Group, managed by Ken Griffin, created the biggest position in Carnival plc (NYSE:CUK). Citadel Investment Group had $11.6 million invested in the company at the end of the quarter. Mike Vranos’s Ellington also made a $0.7 million investment in the stock during the quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Carnival plc (NYSE:CUK). These stocks are LyondellBasell Industries NV (NYSE:LYB), Atlassian Corporation Plc (NASDAQ:TEAM), General Mills, Inc. (NYSE:GIS), and IQVIA Holdings, Inc. (NYSE:IQV). This group of stocks’ market valuations are closest to CUK’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LYB | 45 | 2065988 | 9 |

| TEAM | 36 | 1996530 | 0 |

| GIS | 39 | 1025933 | 7 |

| IQV | 67 | 5892581 | 3 |

| Average | 46.75 | 2745258 | 4.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 46.75 hedge funds with bullish positions and the average amount invested in these stocks was $2745 million. That figure was $121 million in CUK’s case. IQVIA Holdings, Inc. (NYSE:IQV) is the most popular stock in this table. On the other hand Atlassian Corporation Plc (NASDAQ:TEAM) is the least popular one with only 36 bullish hedge fund positions. Compared to these stocks Carnival plc (NYSE:CUK) is even less popular than TEAM. Hedge funds dodged a bullet by taking a bearish stance towards CUK. Our calculations showed that the top 20 most popular hedge fund stocks returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately CUK wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); CUK investors were disappointed as the stock returned -6% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Disclosure: None. This article was originally published at Insider Monkey.