Is Canadian Pacific Railway Limited (NYSE:CP) a good place to invest some of your money right now? We can gain invaluable insight to help us answer that question by studying the investment trends of top investors, who employ world-class Ivy League graduates, who are given immense resources and industry contacts to put their financial expertise to work. The top picks of these firms have historically outperformed the market when we account for known risk factors, making them very valuable investment ideas.

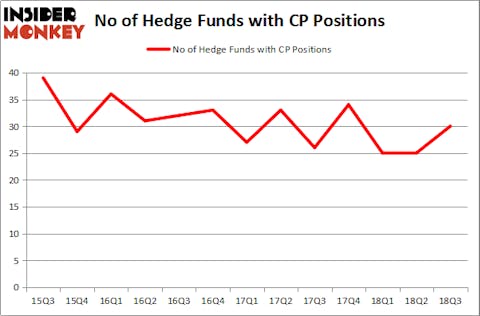

Canadian Pacific Railway Limited (NYSE:CP) has seen an increase in hedge fund interest in recent months. CP was in 30 hedge funds’ portfolios at the end of September. There were 25 hedge funds in our database with CP positions at the end of the previous quarter. Our calculations also showed that CP isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s analyze the recent hedge fund action regarding Canadian Pacific Railway Limited (NYSE:CP).

What have hedge funds been doing with Canadian Pacific Railway Limited (NYSE:CP)?

At the end of the third quarter, a total of 30 of the hedge funds tracked by Insider Monkey were long this stock, a change of 20% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CP over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Lone Pine Capital, managed by Stephen Mandel, holds the most valuable position in Canadian Pacific Railway Limited (NYSE:CP). Lone Pine Capital has a $825.9 million position in the stock, comprising 4.2% of its 13F portfolio. The second largest stake is held by John Armitage of Egerton Capital Limited, with a $593.4 million position; the fund has 4.4% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism consist of Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ken Griffin’s Citadel Investment Group and Scott Ferguson’s Sachem Head Capital.

As aggregate interest increased, some big names have been driving this bullishness. Sachem Head Capital, managed by Scott Ferguson, created the most valuable position in Canadian Pacific Railway Limited (NYSE:CP). Sachem Head Capital had $149.4 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also initiated a $25 million position during the quarter. The other funds with new positions in the stock are Brandon Haley’s Holocene Advisors, Todd J. Kantor’s Encompass Capital Advisors, and Guy Shahar’s DSAM Partners.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Canadian Pacific Railway Limited (NYSE:CP) but similarly valued. We will take a look at Advanced Micro Devices, Inc. (NASDAQ:AMD), TD Ameritrade Holding Corp. (NASDAQ:AMTD), NetEase, Inc (NASDAQ:NTES), and Centene Corp (NYSE:CNC). This group of stocks’ market valuations are similar to CP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AMD | 28 | 600368 | 1 |

| AMTD | 18 | 575391 | -10 |

| NTES | 26 | 3081199 | 2 |

| CNC | 49 | 1980935 | 7 |

| Average | 30.25 | 1559473 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.56 billion. That figure was $2.73 billion in CP’s case. Centene Corp (NYSE:CNC) is the most popular stock in this table. On the other hand TD Ameritrade Holding Corp. (NASDAQ:AMTD) is the least popular one with only 18 bullish hedge fund positions. Canadian Pacific Railway Limited (NYSE:CP) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CNC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.