How do you pick the next stock to invest in? One way would be to spend days of research browsing through thousands of publicly traded companies. However, an easier way is to look at the stocks that smart money investors are collectively bullish on. Hedge funds and other institutional investors usually invest large amounts of capital and have to conduct due diligence while choosing their next pick. They don’t always get it right, but, on average, their stock picks historically generated strong returns after adjusting for known risk factors. With this in mind, let’s take a look at the recent hedge fund activity surrounding CF Industries Holdings, Inc. (NYSE:CF) and determine whether hedge funds had an edge regarding this stock.

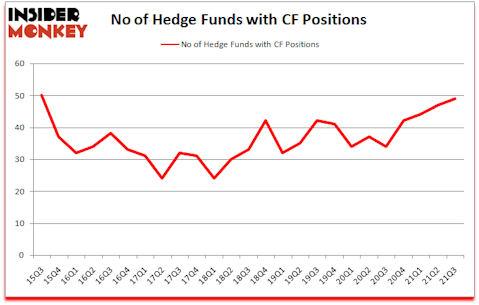

CF Industries Holdings, Inc. (NYSE:CF) shareholders have witnessed an increase in activity from the world’s largest hedge funds in recent months. CF Industries Holdings, Inc. (NYSE:CF) was in 49 hedge funds’ portfolios at the end of September. The all time high for this statistic is 50. Our calculations also showed that CF isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings).

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now let’s take a peek at the recent hedge fund action encompassing CF Industries Holdings, Inc. (NYSE:CF).

Ricky Sandler of Eminence Capital

Do Hedge Funds Think CF Is A Good Stock To Buy Now?

At the end of the third quarter, a total of 49 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the second quarter of 2021. Below, you can check out the change in hedge fund sentiment towards CF over the last 25 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were adding to their holdings meaningfully (or already accumulated large positions).

The largest stake in CF Industries Holdings, Inc. (NYSE:CF) was held by Glendon Capital Management, which reported holding $276.8 million worth of stock at the end of September. It was followed by D E Shaw with a $135.6 million position. Other investors bullish on the company included Millennium Management, Castle Hook Partners, and Eminence Capital. In terms of the portfolio weights assigned to each position Glendon Capital Management allocated the biggest weight to CF Industries Holdings, Inc. (NYSE:CF), around 16.46% of its 13F portfolio. Brightline Capital is also relatively very bullish on the stock, earmarking 10.38 percent of its 13F equity portfolio to CF.

As one would reasonably expect, key hedge funds have been driving this bullishness. Eminence Capital, managed by Ricky Sandler, created the most valuable position in CF Industries Holdings, Inc. (NYSE:CF). Eminence Capital had $70.1 million invested in the company at the end of the quarter. Dan Loeb’s Third Point also made a $55.8 million investment in the stock during the quarter. The other funds with brand new CF positions are David Rosen’s Rubric Capital Management, Dmitry Balyasny’s Balyasny Asset Management, and Suzi Nutton (CEO)’s Lansdowne Partners.

Let’s also examine hedge fund activity in other stocks similar to CF Industries Holdings, Inc. (NYSE:CF). We will take a look at F5, Inc. (NASDAQ:FFIV), Medical Properties Trust, Inc. (NYSE:MPW), Sasol Limited (NYSE:SSL), Steel Dynamics, Inc. (NASDAQ:STLD), Marqeta Inc. (NASDAQ:MQ), Formula One Group (NASDAQ:FWONK), and PulteGroup, Inc. (NYSE:PHM). All of these stocks’ market caps are closest to CF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FFIV | 27 | 686095 | -3 |

| MPW | 18 | 365527 | -1 |

| SSL | 4 | 76164 | -1 |

| STLD | 23 | 481466 | -3 |

| MQ | 20 | 1100795 | 20 |

| FWONK | 40 | 1901404 | -1 |

| PHM | 35 | 771756 | 1 |

| Average | 23.9 | 769030 | 1.7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.9 hedge funds with bullish positions and the average amount invested in these stocks was $769 million. That figure was $1273 million in CF’s case. Formula One Group (NASDAQ:FWONK) is the most popular stock in this table. On the other hand Sasol Limited (NYSE:SSL) is the least popular one with only 4 bullish hedge fund positions. Compared to these stocks CF Industries Holdings, Inc. (NYSE:CF) is more popular among hedge funds. Our overall hedge fund sentiment score for CF is 86.4. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 29.6% in 2021 and managed to beat the market by another 3.6 percentage points. Hedge funds were also right about betting on CF as the stock returned 24% since the end of September (through 1/31) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Cf Industries Holdings Inc. (NYSE:CF)

Follow Cf Industries Holdings Inc. (NYSE:CF)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Cryptocurrency Exchanges in 2020

- 10 Best Communication Equipment Stocks To Buy

- 10 Fastest Growing Franchises in the US in 2020

Disclosure: None. This article was originally published at Insider Monkey.