The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have plowed through 821 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, a week after the market trough. We are almost done with the second quarter. Investors decided to bet on the economic recovery and a stock market rebound. S&P 500 Index returned almost 20% this quarter. In this article we look at how hedge funds traded Thomson Reuters Corporation (NYSE:TRI) and determine whether the smart money was really smart about this stock.

Is Thomson Reuters Corporation (NYSE:TRI) ready to rally soon? Prominent investors were becoming more confident. The number of bullish hedge fund bets improved by 1 lately. Our calculations also showed that TRI isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks).

Video: Watch our video about the top 5 most popular hedge fund stocks.

To the average investor there are tons of indicators investors put to use to appraise their stock investments. Two of the most under-the-radar indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the elite investment managers can outclass the market by a solid margin (see the details here).

John Overdeck of Two Sigma Advisors

At Insider Monkey we scour multiple sources to uncover the next great investment idea. For example, on one site we found out that NBA champion Isiah Thomas is now the CEO of this cannabis company. The same site also talks about a snack manufacturer that’s growing at 30% annually. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Hedge fund sentiment towards Tesla reached its all time high at the end of 2019 and Tesla shares more than tripled this year. We are trying to identify other EV revolution winners, so if you have any good ideas send us an email. Keeping this in mind we’re going to take a look at the recent hedge fund action encompassing Thomson Reuters Corporation (NYSE:TRI).

What does smart money think about Thomson Reuters Corporation (NYSE:TRI)?

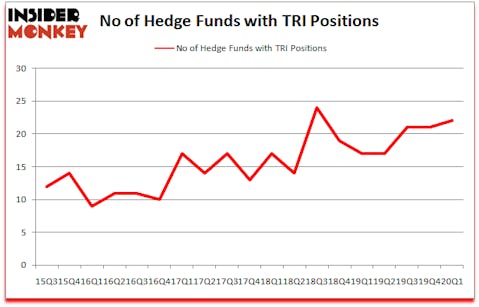

At Q1’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 5% from the fourth quarter of 2019. The graph below displays the number of hedge funds with bullish position in TRI over the last 18 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were adding to their stakes considerably (or already accumulated large positions).

Among these funds, Citadel Investment Group held the most valuable stake in Thomson Reuters Corporation (NYSE:TRI), which was worth $115.4 million at the end of the third quarter. On the second spot was Samlyn Capital which amassed $50 million worth of shares. D E Shaw, Strycker View Capital, and Echo Street Capital Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Strycker View Capital allocated the biggest weight to Thomson Reuters Corporation (NYSE:TRI), around 22.74% of its 13F portfolio. Lunia Capital is also relatively very bullish on the stock, earmarking 3.42 percent of its 13F equity portfolio to TRI.

As one would reasonably expect, some big names were leading the bulls’ herd. Echo Street Capital Management, managed by Greg Poole, assembled the most outsized position in Thomson Reuters Corporation (NYSE:TRI). Echo Street Capital Management had $20.6 million invested in the company at the end of the quarter. Peter Seuss’s Prana Capital Management also made a $3.9 million investment in the stock during the quarter. The other funds with brand new TRI positions are David Rodriguez-Fraile’s BlueMar Capital Management, Ronald Hua’s Qtron Investments, and John Overdeck and David Siegel’s Two Sigma Advisors.

Let’s also examine hedge fund activity in other stocks similar to Thomson Reuters Corporation (NYSE:TRI). We will take a look at UBS Group AG (NYSE:UBS), ConocoPhillips (NYSE:COP), Roper Technologies Inc. (NYSE:ROP), and Sempra Energy (NYSE:SRE). This group of stocks’ market caps are closest to TRI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UBS | 15 | 211262 | 1 |

| COP | 54 | 961915 | -8 |

| ROP | 38 | 1015909 | -2 |

| SRE | 27 | 505194 | -8 |

| Average | 33.5 | 673570 | -4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.5 hedge funds with bullish positions and the average amount invested in these stocks was $674 million. That figure was $330 million in TRI’s case. ConocoPhillips (NYSE:COP) is the most popular stock in this table. On the other hand UBS Group AG (NYSE:UBS) is the least popular one with only 15 bullish hedge fund positions. Thomson Reuters Corporation (NYSE:TRI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.3% in 2020 through June 30th and surpassed the market by 15.5 percentage points. Unfortunately TRI wasn’t nearly as popular as these 10 stocks (hedge fund sentiment was quite bearish); TRI investors were disappointed as the stock returned 0.7% during the second quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 10 most popular stocks among hedge funds as most of these stocks already outperformed the market in 2020.

Follow Thomson Reuters Corp (NASDAQ:TRI)

Follow Thomson Reuters Corp (NASDAQ:TRI)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.