Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of December. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is Viper Energy Partners LP (NASDAQ:VNOM), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

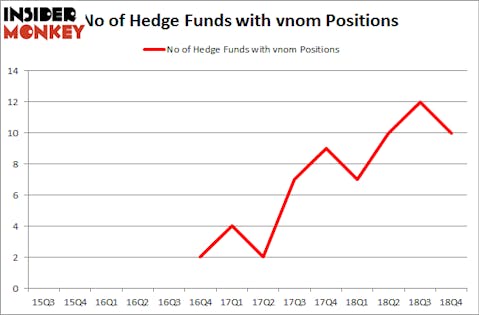

Viper Energy Partners LP (NASDAQ:VNOM) shareholders have witnessed a decrease in enthusiasm from smart money lately. VNOM was in 10 hedge funds’ portfolios at the end of December. There were 12 hedge funds in our database with VNOM positions at the end of the previous quarter. Our calculations also showed that vnom isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a multitude of methods investors put to use to appraise publicly traded companies. Some of the most innovative methods are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outclass the market by a superb amount (see the details here).

Let’s take a peek at the new hedge fund action surrounding Viper Energy Partners LP (NASDAQ:VNOM).

Hedge fund activity in Viper Energy Partners LP (NASDAQ:VNOM)

At Q4’s end, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, a change of -17% from one quarter earlier. By comparison, 7 hedge funds held shares or bullish call options in VNOM a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Amy Minella’s Cardinal Capital has the most valuable position in Viper Energy Partners LP (NASDAQ:VNOM), worth close to $17.8 million, amounting to 0.7% of its total 13F portfolio. Coming in second is Millennium Management, led by Israel Englander, holding a $14.6 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other professional money managers that hold long positions contain George Soros’s Soros Fund Management, Murray Stahl’s Horizon Asset Management and Ken Griffin’s Citadel Investment Group.

Seeing as Viper Energy Partners LP (NASDAQ:VNOM) has witnessed declining sentiment from the aggregate hedge fund industry, it’s safe to say that there exists a select few money managers that decided to sell off their entire stakes heading into Q3. It’s worth mentioning that Louis Navellier’s Navellier & Associates cut the biggest stake of the 700 funds watched by Insider Monkey, comprising about $1.6 million in stock. Robert Jaffe’s fund, Force Capital, also said goodbye to its stock, about $0.9 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 2 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Viper Energy Partners LP (NASDAQ:VNOM). These stocks are Guardant Health, Inc. (NASDAQ:GH), MorphoSys AG (NASDAQ:MOR), Vermilion Energy Inc (NYSE:VET), and AutoNation, Inc. (NYSE:AN). This group of stocks’ market values are closest to VNOM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GH | 7 | 81964 | 7 |

| MOR | 9 | 50915 | 4 |

| VET | 7 | 40542 | -2 |

| AN | 22 | 428351 | -2 |

| Average | 11.25 | 150443 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 11.25 hedge funds with bullish positions and the average amount invested in these stocks was $150 million. That figure was $49 million in VNOM’s case. AutoNation, Inc. (NYSE:AN) is the most popular stock in this table. On the other hand Guardant Health, Inc. (NASDAQ:GH) is the least popular one with only 7 bullish hedge fund positions. Viper Energy Partners LP (NASDAQ:VNOM) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on VNOM as the stock returned 33.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.