We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article we look at what those investors think of Venator Materials PLC (NYSE:VNTR).

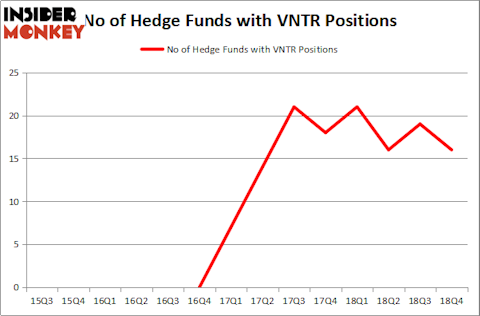

Venator Materials PLC (NYSE:VNTR) investors should be aware of a decrease in support from the world’s most elite money managers lately. Our calculations also showed that VNTR isn’t among the 30 most popular stocks among hedge funds.

In the 21st century investor’s toolkit there are numerous signals market participants put to use to analyze their holdings. A pair of the less utilized signals are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the best money managers can outclass the broader indices by a superb amount (see the details here).

Let’s take a look at the recent hedge fund action surrounding Venator Materials PLC (NYSE:VNTR).

Hedge fund activity in Venator Materials PLC (NYSE:VNTR)

Heading into the first quarter of 2019, a total of 16 of the hedge funds tracked by Insider Monkey were long this stock, a change of -16% from the previous quarter. By comparison, 21 hedge funds held shares or bullish call options in VNTR a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

More specifically, Point72 Asset Management was the largest shareholder of Venator Materials PLC (NYSE:VNTR), with a stake worth $31.6 million reported as of the end of December. Trailing Point72 Asset Management was Adage Capital Management, which amassed a stake valued at $17.7 million. Citadel Investment Group, Luminus Management, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Venator Materials PLC (NYSE:VNTR) has faced declining sentiment from the entirety of the hedge funds we track, it’s safe to say that there exists a select few hedge funds that slashed their entire stakes by the end of the third quarter. Intriguingly, Stuart J. Zimmer’s Zimmer Partners sold off the biggest investment of the 700 funds tracked by Insider Monkey, worth close to $35.6 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also sold off its stock, about $21.1 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Venator Materials PLC (NYSE:VNTR). We will take a look at CalAmp Corp. (NASDAQ:CAMP), UMH Properties, Inc (NYSE:UMH), NII Holdings, Inc. (NASDAQ:NIHD), and Clementia Pharmaceuticals Inc. (NASDAQ:CMTA). This group of stocks’ market valuations are similar to VNTR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CAMP | 15 | 32666 | -2 |

| UMH | 8 | 13751 | -1 |

| NIHD | 18 | 117146 | 1 |

| CMTA | 12 | 216373 | 2 |

| Average | 13.25 | 94984 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.25 hedge funds with bullish positions and the average amount invested in these stocks was $95 million. That figure was $74 million in VNTR’s case. NII Holdings, Inc. (NASDAQ:NIHD) is the most popular stock in this table. On the other hand UMH Properties, Inc (NYSE:UMH) is the least popular one with only 8 bullish hedge fund positions. Venator Materials PLC (NYSE:VNTR) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on VNTR as the stock returned 67.1% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.