As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and recouped their losses by the end of the first quarter. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about The Western Union Company (NYSE:WU).

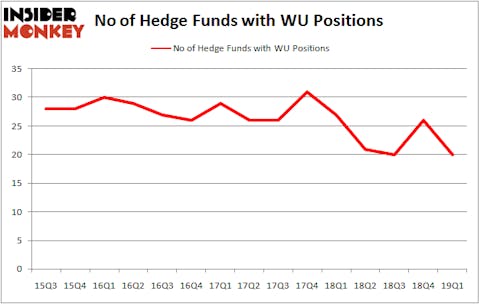

The Western Union Company (NYSE:WU) was in 20 hedge funds’ portfolios at the end of the first quarter of 2019. WU shareholders have witnessed a decrease in hedge fund interest in recent months. There were 26 hedge funds in our database with WU positions at the end of the previous quarter. Our calculations also showed that WU isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools stock market investors put to use to assess stocks. A pair of the most innovative tools are hedge fund and insider trading indicators. Our researchers have shown that, historically, those who follow the best picks of the elite hedge fund managers can outpace the S&P 500 by a solid margin (see the details here).

We’re going to go over the key hedge fund action encompassing The Western Union Company (NYSE:WU).

How are hedge funds trading The Western Union Company (NYSE:WU)?

At Q1’s end, a total of 20 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards WU over the last 15 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were boosting their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in The Western Union Company (NYSE:WU). Renaissance Technologies has a $70.2 million position in the stock, comprising 0.1% of its 13F portfolio. The second largest stake is held by D E Shaw, managed by D. E. Shaw, which holds a $68.7 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish consist of Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, David Harding’s Winton Capital Management and Bernard Horn’s Polaris Capital Management.

Seeing as The Western Union Company (NYSE:WU) has experienced bearish sentiment from the smart money, it’s safe to say that there exists a select few funds who were dropping their full holdings in the third quarter. At the top of the heap, David Abrams’s Abrams Capital Management dumped the biggest position of the “upper crust” of funds followed by Insider Monkey, totaling close to $178 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund said goodbye to about $9.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 6 funds in the third quarter.

Let’s now review hedge fund activity in other stocks similar to The Western Union Company (NYSE:WU). These stocks are IPG Photonics Corporation (NASDAQ:IPGP), Formula One Group (NASDAQ:FWONA), Etsy Inc (NASDAQ:ETSY), and SEI Investments Company (NASDAQ:SEIC). This group of stocks’ market values are similar to WU’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IPGP | 13 | 120021 | -3 |

| FWONA | 21 | 321009 | 2 |

| ETSY | 39 | 1202165 | 0 |

| SEIC | 24 | 334310 | -1 |

| Average | 24.25 | 494376 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.25 hedge funds with bullish positions and the average amount invested in these stocks was $494 million. That figure was $417 million in WU’s case. Etsy Inc (NASDAQ:ETSY) is the most popular stock in this table. On the other hand IPG Photonics Corporation (NASDAQ:IPGP) is the least popular one with only 13 bullish hedge fund positions. The Western Union Company (NYSE:WU) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on WU as the stock returned 4.5% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.