Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in The Medicines Company (NASDAQ:MDCO)? The smart money sentiment can provide an answer to this question.

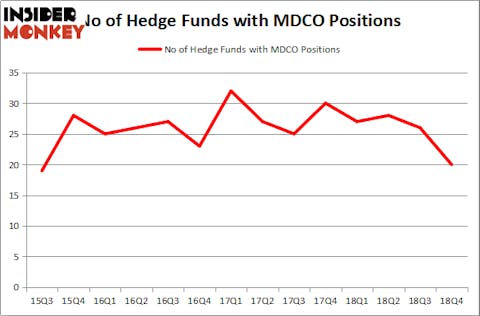

The Medicines Company (NASDAQ:MDCO) has experienced a decrease in hedge fund sentiment of late. Our calculations also showed that MDCO isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a peek at the new hedge fund action regarding The Medicines Company (NASDAQ:MDCO).

How are hedge funds trading The Medicines Company (NASDAQ:MDCO)?

Heading into the first quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -23% from the second quarter of 2018. By comparison, 27 hedge funds held shares or bullish call options in MDCO a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Maverick Capital was the largest shareholder of The Medicines Company (NASDAQ:MDCO), with a stake worth $67.3 million reported as of the end of December. Trailing Maverick Capital was Iridian Asset Management, which amassed a stake valued at $63.1 million. Bridger Management, Sarissa Capital Management, and Slate Path Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as The Medicines Company (NASDAQ:MDCO) has experienced bearish sentiment from the aggregate hedge fund industry, we can see that there was a specific group of hedgies that elected to cut their positions entirely last quarter. Intriguingly, Zach Schreiber’s Point State Capital dropped the biggest stake of the 700 funds followed by Insider Monkey, totaling an estimated $87.6 million in stock, and Christopher James’s Partner Fund Management was right behind this move, as the fund dropped about $76.6 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 6 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as The Medicines Company (NASDAQ:MDCO) but similarly valued. These stocks are Office Depot Inc (NASDAQ:ODP), Compass Minerals International, Inc. (NYSE:CMP), STAAR Surgical Company (NASDAQ:STAA), and Alamos Gold Inc (NYSE:AGI). All of these stocks’ market caps match MDCO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ODP | 24 | 83184 | 4 |

| CMP | 12 | 96774 | 1 |

| STAA | 20 | 598030 | -4 |

| AGI | 11 | 71999 | 1 |

| Average | 16.75 | 212497 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.75 hedge funds with bullish positions and the average amount invested in these stocks was $212 million. That figure was $423 million in MDCO’s case. Office Depot Inc (NASDAQ:ODP) is the most popular stock in this table. On the other hand Alamos Gold Inc (NYSE:AGI) is the least popular one with only 11 bullish hedge fund positions. The Medicines Company (NASDAQ:MDCO) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on MDCO as the stock returned 48.3% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.