Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility. The fourth quarter of 2018 is one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by nearly 7 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have seen some volatility in their portfolios too. Actually their moves are potentially one of the factors that contributed to this volatility. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Spectrum Brands Holdings, Inc. (NYSE:SPB).

Is Spectrum Brands Holdings, Inc. (NYSE:SPB) an outstanding stock to buy now? The smart money is becoming less confident. The number of bullish hedge fund positions dropped by 1 lately. Our calculations also showed that SPB isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a glance at the key hedge fund action regarding Spectrum Brands Holdings, Inc. (NYSE:SPB).

What have hedge funds been doing with Spectrum Brands Holdings, Inc. (NYSE:SPB)?

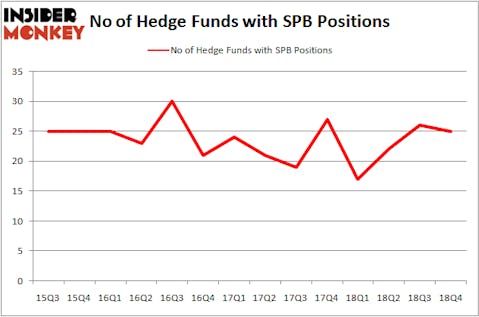

At the end of the fourth quarter, a total of 25 of the hedge funds tracked by Insider Monkey were long this stock, a change of -4% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in SPB over the last 14 quarters. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

More specifically, Leucadia National was the largest shareholder of Spectrum Brands Holdings, Inc. (NYSE:SPB), with a stake worth $317.5 million reported as of the end of September. Trailing Leucadia National was Arlington Value Capital, which amassed a stake valued at $129 million. Cardinal Capital, Moerus Capital Management, and Cove Street Capital were also very fond of the stock, giving the stock large weights in their portfolios.

Due to the fact that Spectrum Brands Holdings, Inc. (NYSE:SPB) has faced bearish sentiment from the smart money, it’s safe to say that there exists a select few hedge funds who sold off their entire stakes by the end of the third quarter. Interestingly, Ken Griffin’s Citadel Investment Group dumped the largest stake of the 700 funds tracked by Insider Monkey, worth close to $58.2 million in call options. Isaac Corre’s fund, Governors Lane, also dropped its call options, about $44.8 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest fell by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Spectrum Brands Holdings, Inc. (NYSE:SPB) but similarly valued. These stocks are SiteOne Landscape Supply, Inc. (NYSE:SITE), Alliance Resource Partners, L.P. (NASDAQ:ARLP), Tempur Sealy International Inc. (NYSE:TPX), and Patterson-UTI Energy, Inc. (NASDAQ:PTEN). All of these stocks’ market caps are similar to SPB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SITE | 11 | 38041 | -4 |

| ARLP | 8 | 96584 | -1 |

| TPX | 31 | 1015114 | 1 |

| PTEN | 39 | 235916 | 8 |

| Average | 22.25 | 346414 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 22.25 hedge funds with bullish positions and the average amount invested in these stocks was $346 million. That figure was $577 million in SPB’s case. Patterson-UTI Energy, Inc. (NASDAQ:PTEN) is the most popular stock in this table. On the other hand Alliance Resource Partners, L.P. (NASDAQ:ARLP) is the least popular one with only 8 bullish hedge fund positions. Spectrum Brands Holdings, Inc. (NYSE:SPB) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on SPB as the stock returned 45.1% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.