The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We have processed the filings of the more than 700 world-class investment firms that we track and now have access to the collective wisdom contained in these filings, which are based on their December 31 holdings, data that is available nowhere else. Should you consider Santander Consumer USA Holdings Inc (NYSE:SC) for your portfolio? We’ll look to this invaluable collective wisdom for the answer.

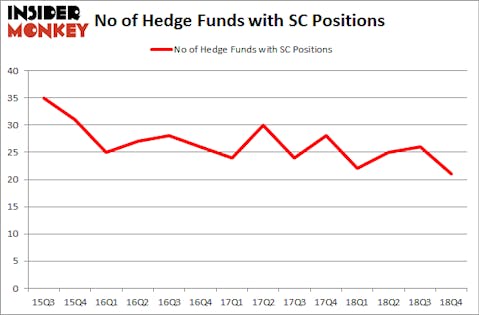

Santander Consumer USA Holdings Inc (NYSE:SC) investors should be aware of a decrease in support from the world’s most elite money managers in recent months. SC was in 21 hedge funds’ portfolios at the end of December. There were 26 hedge funds in our database with SC holdings at the end of the previous quarter. Our calculations also showed that SC isn’t among the 30 most popular stocks among hedge funds.

If you’d ask most market participants, hedge funds are perceived as unimportant, old financial vehicles of years past. While there are more than 8000 funds in operation today, Our researchers look at the upper echelon of this group, about 750 funds. These hedge fund managers command bulk of the smart money’s total capital, and by observing their matchless investments, Insider Monkey has uncovered many investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a look at the new hedge fund action surrounding Santander Consumer USA Holdings Inc (NYSE:SC).

How have hedgies been trading Santander Consumer USA Holdings Inc (NYSE:SC)?

At Q4’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SC over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Santander Consumer USA Holdings Inc (NYSE:SC) was held by Windacre Partnership, which reported holding $179.7 million worth of stock at the end of September. It was followed by Canyon Capital Advisors with a $119.2 million position. Other investors bullish on the company included Arrowstreet Capital, Point72 Asset Management, and Water Street Capital.

Seeing as Santander Consumer USA Holdings Inc (NYSE:SC) has witnessed falling interest from hedge fund managers, it’s easy to see that there was a specific group of hedge funds who were dropping their positions entirely by the end of the third quarter. It’s worth mentioning that Ken Griffin’s Citadel Investment Group dropped the largest position of the 700 funds followed by Insider Monkey, totaling an estimated $35 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund cut about $19.9 million worth. These moves are important to note, as total hedge fund interest fell by 5 funds by the end of the third quarter.

Let’s check out hedge fund activity in other stocks similar to Santander Consumer USA Holdings Inc (NYSE:SC). We will take a look at East West Bancorp, Inc. (NASDAQ:EWBC), Dolby Laboratories, Inc. (NYSE:DLB), Commerce Bancshares, Inc. (NASDAQ:CBSH), and Gildan Activewear Inc (NYSE:GIL). This group of stocks’ market valuations match SC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EWBC | 27 | 461953 | -2 |

| DLB | 23 | 493936 | -6 |

| CBSH | 11 | 82148 | -1 |

| GIL | 25 | 511310 | 7 |

| Average | 21.5 | 387337 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $387 million. That figure was $565 million in SC’s case. East West Bancorp, Inc. (NASDAQ:EWBC) is the most popular stock in this table. On the other hand Commerce Bancshares, Inc. (NASDAQ:CBSH) is the least popular one with only 11 bullish hedge fund positions. Santander Consumer USA Holdings Inc (NYSE:SC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on SC as the stock returned 26.6% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.