Like everyone else, elite investors make mistakes. Some of their top consensus picks, such as Amazon, Facebook and Alibaba, have not done well in October due to various reasons. Nevertheless, the data show elite investors’ consensus picks have done well on average over the long-term. The top 30 S&P 500 stocks among hedge funds at the end of September 2018 returned an average of 6.7% through November 15th whereas the S&P 500 Index ETF gained only 2.6% during the same period. Because their consensus picks have done well, we pay attention to what elite funds think before doing extensive research on a stock. In this article, we take a closer look at Santander Consumer USA Holdings Inc (NYSE:SC) from the perspective of those elite funds.

Santander Consumer USA Holdings Inc (NYSE:SC) investors should be aware of an increase in hedge fund interest lately. Our calculations also showed that sc isn’t among the 30 most popular stocks among hedge funds.

Today there are a large number of formulas shareholders put to use to evaluate their stock investments. A couple of the best formulas are hedge fund and insider trading signals. We have shown that, historically, those who follow the best picks of the best investment managers can trounce their index-focused peers by a significant margin (see the details here).

Let’s view the new hedge fund action surrounding Santander Consumer USA Holdings Inc (NYSE:SC).

What does the smart money think about Santander Consumer USA Holdings Inc (NYSE:SC)?

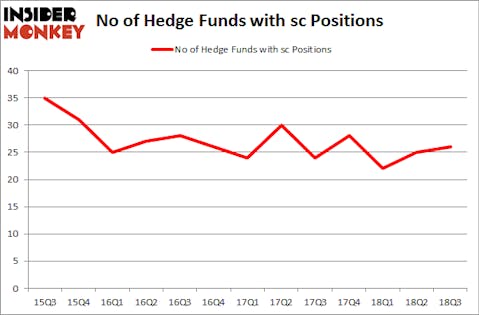

Heading into the fourth quarter of 2018, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in SC over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Joshua Friedman and Mitchell Julis’s Canyon Capital Advisors has the largest position in Santander Consumer USA Holdings Inc (NYSE:SC), worth close to $110 million, comprising 1.5% of its total 13F portfolio. Sitting at the No. 2 spot is Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, which holds a $65.6 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining hedge funds and institutional investors that are bullish encompass Steve Cohen’s Point72 Asset Management, Robert Pohly’s Samlyn Capital and Ken Griffin’s Citadel Investment Group.

As aggregate interest increased, specific money managers were leading the bulls’ herd. Hudson Bay Capital Management, managed by Sander Gerber, assembled the most valuable call position in Santander Consumer USA Holdings Inc (NYSE:SC). Hudson Bay Capital Management had $4 million invested in the company at the end of the quarter. Joe DiMenna’s ZWEIG DIMENNA PARTNERS also initiated a $0.3 million position during the quarter.

Let’s check out hedge fund activity in other stocks similar to Santander Consumer USA Holdings Inc (NYSE:SC). These stocks are Kilroy Realty Corp (NYSE:KRC), The Middleby Corporation (NASDAQ:MIDD), ADT Inc. (NYSE:ADT), and Sabre Corporation (NASDAQ:SABR). This group of stocks’ market caps are similar to SC’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| KRC | 12 | 253236 | 0 |

| MIDD | 17 | 816140 | 3 |

| ADT | 19 | 147423 | 4 |

| SABR | 31 | 605722 | 6 |

| Average | 19.75 | 455630 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.75 hedge funds with bullish positions and the average amount invested in these stocks was $456 million. That figure was $491 million in SC’s case. Sabre Corporation (NASDAQ:SABR) is the most popular stock in this table. On the other hand Kilroy Realty Corp (NYSE:KRC) is the least popular one with only 12 bullish hedge fund positions. Santander Consumer USA Holdings Inc (NYSE:SC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SABR might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.