As we already know from media reports and hedge fund investor letters, many hedge funds lost money in fourth quarter, blaming macroeconomic conditions and unpredictable events that hit several sectors, with technology among them. Nevertheless, most investors decided to stick to their bullish theses and their long-term focus allows us to profit from the recent declines. In particular, let’s take a look at what hedge funds think about PROS Holdings, Inc. (NYSE:PRO) in this article.

Is PROS Holdings, Inc. (NYSE:PRO) worth your attention right now? Investors who are in the know are becoming less confident. The number of long hedge fund positions went down by 1 lately. Our calculations also showed that pro isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most shareholders, hedge funds are perceived as underperforming, outdated investment vehicles of yesteryear. While there are greater than 8000 funds with their doors open today, We choose to focus on the upper echelon of this club, around 750 funds. These hedge fund managers have their hands on most of the smart money’s total asset base, and by monitoring their first-class stock picks, Insider Monkey has determined many investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Let’s take a gander at the latest hedge fund action surrounding PROS Holdings, Inc. (NYSE:PRO).

What does the smart money think about PROS Holdings, Inc. (NYSE:PRO)?

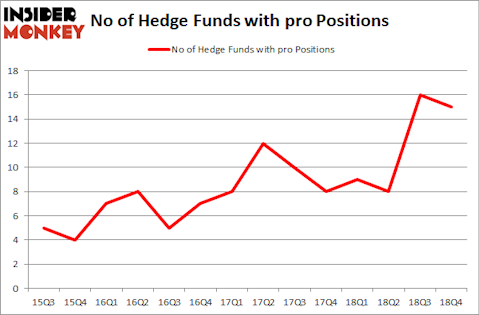

Heading into the first quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the previous quarter. The graph below displays the number of hedge funds with bullish position in PRO over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Daruma Asset Management was the largest shareholder of PROS Holdings, Inc. (NYSE:PRO), with a stake worth $32.1 million reported as of the end of December. Trailing Daruma Asset Management was Whetstone Capital Advisors, which amassed a stake valued at $20.8 million. SQN Investors, Shannon River Fund Management, and Millennium Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because PROS Holdings, Inc. (NYSE:PRO) has experienced a decline in interest from hedge fund managers, logic holds that there was a specific group of hedge funds that slashed their entire stakes by the end of the third quarter. Interestingly, Paul Marshall and Ian Wace’s Marshall Wace LLP cut the biggest position of all the hedgies watched by Insider Monkey, totaling an estimated $11.7 million in stock, and Benjamin A. Smith’s Laurion Capital Management was right behind this move, as the fund sold off about $5.3 million worth. These bearish behaviors are important to note, as total hedge fund interest was cut by 1 funds by the end of the third quarter.

Let’s now review hedge fund activity in other stocks similar to PROS Holdings, Inc. (NYSE:PRO). These stocks are TiVo Corporation (NASDAQ:TIVO), 3D Systems Corporation (NYSE:DDD), Big Lots, Inc. (NYSE:BIG), and CorVel Corporation (NASDAQ:CRVL). This group of stocks’ market values match PRO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TIVO | 19 | 90952 | 1 |

| DDD | 11 | 50546 | -3 |

| BIG | 19 | 137809 | 0 |

| CRVL | 15 | 112790 | 4 |

| Average | 16 | 98024 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16 hedge funds with bullish positions and the average amount invested in these stocks was $98 million. That figure was $112 million in PRO’s case. TiVo Corporation (NASDAQ:TIVO) is the most popular stock in this table. On the other hand 3D Systems Corporation (NYSE:DDD) is the least popular one with only 11 bullish hedge fund positions. PROS Holdings, Inc. (NYSE:PRO) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on PRO as the stock returned 38.7% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.