There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Och-Ziff Capital Management Group LLC (NYSE:OZM).

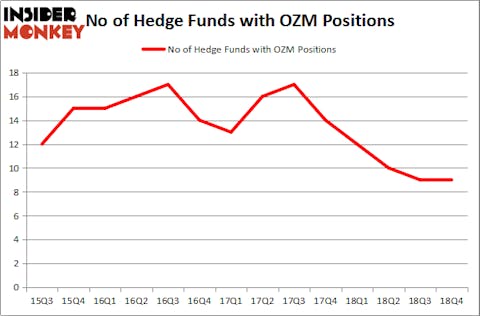

Hedge fund interest in Och-Ziff Capital Management Group LLC (NYSE:OZM) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare OZM to other stocks including CONSOL Coal Resources LP (NYSE:CCR), Forum Energy Technologies Inc (NYSE:FET), and Kezar Life Sciences, Inc. (NASDAQ:KZR) to get a better sense of its popularity.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a look at the recent hedge fund action regarding Och-Ziff Capital Management Group LLC (NYSE:OZM).

How are hedge funds trading Och-Ziff Capital Management Group LLC (NYSE:OZM)?

At the end of the fourth quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in OZM a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Och-Ziff Capital Management Group LLC (NYSE:OZM) was held by Odey Asset Management Group, which reported holding $54.9 million worth of stock at the end of December. It was followed by Abrams Capital Management with a $20.5 million position. Other investors bullish on the company included North Run Capital, Kamunting Street Capital, and Royce & Associates.

Since Och-Ziff Capital Management Group LLC (NYSE:OZM) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of hedge funds that decided to sell off their positions entirely in the third quarter. Interestingly, Jim Simons’s Renaissance Technologies dumped the biggest stake of the “upper crust” of funds followed by Insider Monkey, valued at close to $0.2 million in call options, and Ken Griffin’s Citadel Investment Group was right behind this move, as the fund sold off about $0 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to Och-Ziff Capital Management Group LLC (NYSE:OZM). We will take a look at CONSOL Coal Resources LP (NYSE:CCR), Forum Energy Technologies Inc (NYSE:FET), Kezar Life Sciences, Inc. (NASDAQ:KZR), and The Bancorp, Inc. (NASDAQ:TBBK). This group of stocks’ market caps are closest to OZM’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCR | 5 | 97486 | 1 |

| FET | 11 | 52956 | 2 |

| KZR | 4 | 67447 | -3 |

| TBBK | 14 | 70000 | 1 |

| Average | 8.5 | 71972 | 0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 8.5 hedge funds with bullish positions and the average amount invested in these stocks was $72 million. That figure was $82 million in OZM’s case. The Bancorp, Inc. (NASDAQ:TBBK) is the most popular stock in this table. On the other hand Kezar Life Sciences, Inc. (NASDAQ:KZR) is the least popular one with only 4 bullish hedge fund positions. Och-Ziff Capital Management Group LLC (NYSE:OZM) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on OZM as the stock returned 60.9% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.