Hedge funds are known to underperform the bull markets but that’s not because they are bad at investing. Truth be told, most hedge fund managers and other smaller players within this industry are very smart and skilled investors. Of course, they may also make wrong bets in some instances, but no one knows what the future holds and how market participants will react to the bountiful news that floods in each day. Hedge funds underperform because they are hedged. The Standard and Poor’s 500 Index returned approximately 13.1% in the first 2.5 months of this year (including dividend payments). Conversely, hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the same 2.5-month period, with 93% of these stock picks outperforming the broader market benchmark. An average long/short hedge fund returned only 5% due to the hedges they implement and the large fees they charge. Our research covering the last 18 years indicates that investors can outperform the market by imitating hedge funds’ stock picks rather than directly investing in hedge funds. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like Oaktree Capital Group LLC (NYSE:OAK).

Hedge fund interest in Oaktree Capital Group LLC (NYSE:OAK) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare OAK to other stocks including Voya Financial Inc (NYSE:VOYA), Berry Global Group Inc (NYSE:BERY), and Old Republic International Corporation (NYSE:ORI) to get a better sense of its popularity.

In today’s marketplace there are a lot of formulas stock market investors put to use to size up stocks. A duo of the most underrated formulas are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the elite money managers can outperform the market by a significant amount (see the details here).

We’re going to take a look at the fresh hedge fund action surrounding Oaktree Capital Group LLC (NYSE:OAK).

How are hedge funds trading Oaktree Capital Group LLC (NYSE:OAK)?

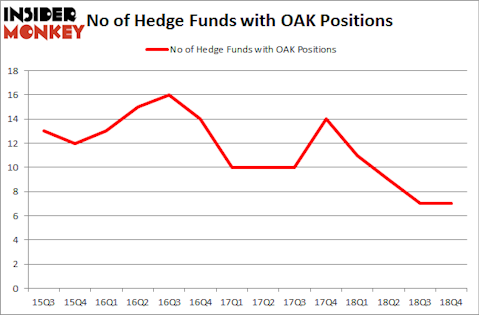

At Q4’s end, a total of 7 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards OAK over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, John W. Rogers’s Ariel Investments has the largest position in Oaktree Capital Group LLC (NYSE:OAK), worth close to $80.3 million, accounting for 1.1% of its total 13F portfolio. The second largest stake is held by Markel Gayner Asset Management, led by Tom Gayner, holding a $40.6 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism comprise Chuck Royce’s Royce & Associates, Murray Stahl’s Horizon Asset Management and Mark Travis’s Intrepid Capital Management.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s check out hedge fund activity in other stocks similar to Oaktree Capital Group LLC (NYSE:OAK). These stocks are Voya Financial Inc (NYSE:VOYA), Berry Global Group Inc (NYSE:BERY), Old Republic International Corporation (NYSE:ORI), and Liberty Property Trust (NYSE:LPT). All of these stocks’ market caps match OAK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VOYA | 38 | 988902 | 0 |

| BERY | 43 | 2132320 | 7 |

| ORI | 23 | 410291 | 3 |

| LPT | 19 | 175996 | 1 |

| Average | 30.75 | 926877 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 30.75 hedge funds with bullish positions and the average amount invested in these stocks was $927 million. That figure was $184 million in OAK’s case. Berry Global Group Inc (NYSE:BERY) is the most popular stock in this table. On the other hand Liberty Property Trust (NYSE:LPT) is the least popular one with only 19 bullish hedge fund positions. Compared to these stocks Oaktree Capital Group LLC (NYSE:OAK) is even less popular than LPT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Hedge funds were also right about betting on OAK as the stock returned 27.8% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.