A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended December 31, so let’s proceed with the discussion of the hedge fund sentiment on Nomad Foods Limited (NYSE:NOMD).

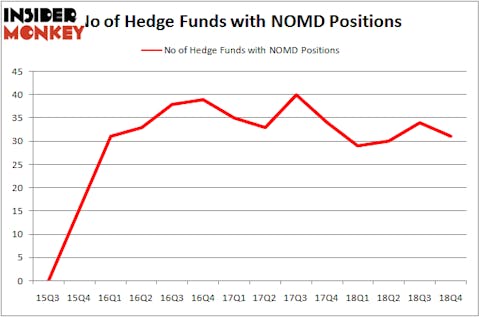

Nomad Foods Limited (NYSE:NOMD) shareholders have witnessed a decrease in hedge fund interest of late. NOMD was in 31 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 34 hedge funds in our database with NOMD positions at the end of the previous quarter. Our calculations also showed that NOMD isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 20.7% year to date (through March 12th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 32 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s analyze the fresh hedge fund action surrounding Nomad Foods Limited (NYSE:NOMD).

What have hedge funds been doing with Nomad Foods Limited (NYSE:NOMD)?

At Q4’s end, a total of 31 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in NOMD over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, Samlyn Capital was the largest shareholder of Nomad Foods Limited (NYSE:NOMD), with a stake worth $60.2 million reported as of the end of September. Trailing Samlyn Capital was GMT Capital, which amassed a stake valued at $35.3 million. Ancora Advisors, Citadel Investment Group, and Woodson Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Because Nomad Foods Limited (NYSE:NOMD) has experienced a decline in interest from the entirety of the hedge funds we track, it’s easy to see that there was a specific group of hedge funds that decided to sell off their positions entirely by the end of the third quarter. It’s worth mentioning that Kerr Neilson’s Platinum Asset Management said goodbye to the largest stake of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $15.6 million in stock. Dmitry Balyasny’s fund, Balyasny Asset Management, also dropped its stock, about $7.6 million worth. These moves are interesting, as aggregate hedge fund interest was cut by 3 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Nomad Foods Limited (NYSE:NOMD) but similarly valued. These stocks are GDS Holdings Limited (NASDAQ:GDS), Yelp Inc (NYSE:YELP), Evercore Inc. (NYSE:EVR), and Antero Resources Corp (NYSE:AR). This group of stocks’ market caps match NOMD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GDS | 25 | 426393 | -1 |

| YELP | 24 | 577668 | -6 |

| EVR | 24 | 303273 | 2 |

| AR | 22 | 920124 | 2 |

| Average | 23.75 | 556865 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.75 hedge funds with bullish positions and the average amount invested in these stocks was $557 million. That figure was $252 million in NOMD’s case. GDS Holdings Limited (NASDAQ:GDS) is the most popular stock in this table. On the other hand Antero Resources Corp (NYSE:AR) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks Nomad Foods Limited (NYSE:NOMD) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on NOMD as the stock returned 25% and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.