Although the masses and most of the financial media blame hedge funds for their exorbitant fee structure and disappointing performance, these investors have proved to have great stock picking abilities over the years (that’s why their assets under management continue to swell). We believe hedge fund sentiment should serve as a crucial tool of an individual investor’s stock selection process, as it may offer great insights of how the brightest minds of the finance industry feel about specific stocks. After all, these people have access to smartest analysts and expensive data/information sources that individual investors can’t match. So should one consider investing in Navistar International Corp (NYSE:NAV)? The smart money sentiment can provide an answer to this question.

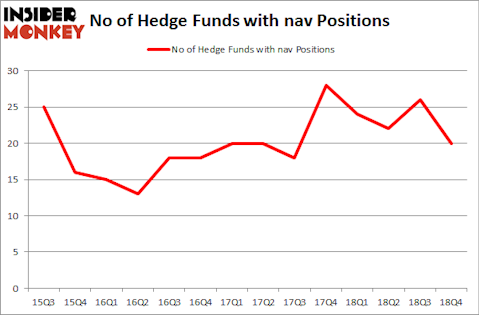

Is Navistar International Corp (NYSE:NAV) the right investment to pursue these days? The best stock pickers are in a pessimistic mood. The number of long hedge fund positions were trimmed by 6 recently. Our calculations also showed that nav isn’t among the 30 most popular stocks among hedge funds. NAV was in 20 hedge funds’ portfolios at the end of December. There were 26 hedge funds in our database with NAV holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the new hedge fund action regarding Navistar International Corp (NYSE:NAV).

Hedge fund activity in Navistar International Corp (NYSE:NAV)

Heading into the first quarter of 2019, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -23% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in NAV over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Icahn Capital LP was the largest shareholder of Navistar International Corp (NYSE:NAV), with a stake worth $434.1 million reported as of the end of September. Trailing Icahn Capital LP was MHR Fund Management, which amassed a stake valued at $421 million. GAMCO Investors, Citadel Investment Group, and Renaissance Technologies were also very fond of the stock, giving the stock large weights in their portfolios.

Since Navistar International Corp (NYSE:NAV) has witnessed falling interest from the aggregate hedge fund industry, logic holds that there exists a select few hedge funds who were dropping their positions entirely last quarter. Interestingly, Mario Gabelli’s GAMCO Investors sold off the largest investment of the “upper crust” of funds tracked by Insider Monkey, worth an estimated $199.2 million in stock. John Osterweis’s fund, Osterweis Capital Management, also sold off its stock, about $61.3 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 6 funds last quarter.

Let’s check out hedge fund activity in other stocks similar to Navistar International Corp (NYSE:NAV). These stocks are Texas Capital Bancshares Inc (NASDAQ:TCBI), Sinclair Broadcast Group, Inc. (NASDAQ:SBGI), BRP Inc. (NASDAQ:DOOO), and FTI Consulting, Inc. (NYSE:FCN). This group of stocks’ market valuations are similar to NAV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TCBI | 26 | 241493 | 4 |

| SBGI | 33 | 378016 | 2 |

| DOOO | 11 | 121922 | -5 |

| FCN | 16 | 116498 | -2 |

| Average | 21.5 | 214482 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21.5 hedge funds with bullish positions and the average amount invested in these stocks was $214 million. That figure was $1055 million in NAV’s case. Sinclair Broadcast Group, Inc. (NASDAQ:SBGI) is the most popular stock in this table. On the other hand BRP Inc. (NASDAQ:DOOO) is the least popular one with only 11 bullish hedge fund positions. Navistar International Corp (NYSE:NAV) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on NAV as the stock returned 33.8% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.