Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018 as investors first worried over the possible ramifications of rising interest rates and the escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only about 60% S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of Moderna, Inc. (NASDAQ:MRNA) and see how the stock is affected by the recent hedge fund activity.

Moderna, Inc. (NASDAQ:MRNA) has experienced a decrease in enthusiasm from smart money of late. Our calculations also showed that MRNA isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Today there are numerous formulas investors use to appraise their stock investments. A pair of the less utilized formulas are hedge fund and insider trading moves. Our researchers have shown that, historically, those who follow the top picks of the elite investment managers can outclass their index-focused peers by a solid amount (see the details here).

Andreas Halvorsen of Viking Global

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We also rely on the best performing hedge funds‘ buy/sell signals. Let’s go over the fresh hedge fund action regarding Moderna, Inc. (NASDAQ:MRNA).

How are hedge funds trading Moderna, Inc. (NASDAQ:MRNA)?

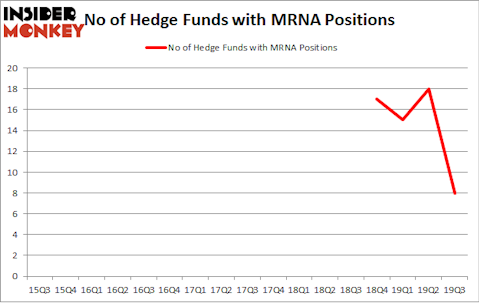

Heading into the fourth quarter of 2019, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, a change of -56% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards MRNA over the last 17 quarters. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

Among these funds, Theleme Partners held the most valuable stake in Moderna, Inc. (NASDAQ:MRNA), which was worth $89.4 million at the end of the third quarter. On the second spot was Viking Global which amassed $74.5 million worth of shares. Platinum Asset Management, Hillhouse Capital Management, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Theleme Partners allocated the biggest weight to Moderna, Inc. (NASDAQ:MRNA), around 4.13% of its 13F portfolio. Platinum Asset Management is also relatively very bullish on the stock, designating 0.52 percent of its 13F equity portfolio to MRNA.

Judging by the fact that Moderna, Inc. (NASDAQ:MRNA) has experienced declining sentiment from the entirety of the hedge funds we track, logic holds that there was a specific group of hedgies that decided to sell off their full holdings by the end of the third quarter. Intriguingly, Jonathan Barrett and Paul Segal’s Luminus Management cut the largest position of all the hedgies watched by Insider Monkey, worth close to $10.2 million in stock. James Crichton’s fund, Hitchwood Capital Management, also sold off its stock, about $5.1 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest was cut by 10 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Moderna, Inc. (NASDAQ:MRNA). These stocks are JBG SMITH Properties (NYSE:JBGS), Cree, Inc. (NASDAQ:CREE), Dynatrace, Inc. (NYSE:DT), and Enable Midstream Partners LP (NYSE:ENBL). This group of stocks’ market values resemble MRNA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JBGS | 19 | 235290 | 2 |

| CREE | 22 | 357481 | -2 |

| DT | 20 | 147275 | 20 |

| ENBL | 5 | 27783 | -2 |

| Average | 16.5 | 191957 | 4.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $192 million. That figure was $205 million in MRNA’s case. Cree, Inc. (NASDAQ:CREE) is the most popular stock in this table. On the other hand Enable Midstream Partners LP (NYSE:ENBL) is the least popular one with only 5 bullish hedge fund positions. Moderna, Inc. (NASDAQ:MRNA) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on MRNA as the stock returned 27.9% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.