Amid an overall market correction, many stocks that smart money investors were collectively bullish on tanked during the fourth quarter. Among them, Amazon and Netflix ranked among the top 30 picks and both lost more than 25%. Facebook, which was the second most popular stock, lost 20% amid uncertainty regarding the interest rates and tech valuations. Nevertheless, our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 15 large-cap stock picks generated a return of 19.7% during the first 2.5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

Is Medidata Solutions Inc (NASDAQ:MDSO) a bargain? Hedge funds are in a pessimistic mood. The number of long hedge fund positions fell by 3 in recent months. Our calculations also showed that MDSO isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s take a peek at the recent hedge fund action surrounding Medidata Solutions Inc (NASDAQ:MDSO).

Hedge fund activity in Medidata Solutions Inc (NASDAQ:MDSO)

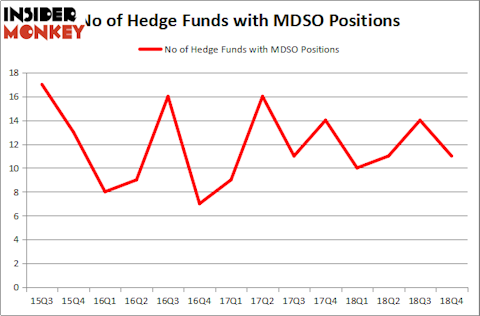

At Q4’s end, a total of 11 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -21% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards MDSO over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the biggest position in Medidata Solutions Inc (NASDAQ:MDSO). Royce & Associates has a $73.8 million position in the stock, comprising 0.7% of its 13F portfolio. The second largest stake is held by Polar Capital, led by Brian Ashford-Russell and Tim Woolley, holding a $41.4 million position; the fund has 0.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism include Greg Poole’s Echo Street Capital Management, and Ken Griffin’s Citadel Investment Group.

Because Medidata Solutions Inc (NASDAQ:MDSO) has witnessed declining sentiment from the aggregate hedge fund industry, it’s easy to see that there lies a certain “tier” of hedge funds that elected to cut their positions entirely heading into Q3. Interestingly, David Atterbury’s Whetstone Capital Advisors dumped the largest stake of the “upper crust” of funds followed by Insider Monkey, worth an estimated $4.9 million in stock, and Richard Driehaus’s Driehaus Capital was right behind this move, as the fund dumped about $1.9 million worth. These bearish behaviors are interesting, as total hedge fund interest was cut by 3 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Medidata Solutions Inc (NASDAQ:MDSO). These stocks are Compania de Minas Buenaventura SA (NYSE:BVN), Eaton Vance Corp (NYSE:EV), VEON Ltd. (NASDAQ:VEON), and Portland General Electric Company (NYSE:POR). All of these stocks’ market caps are closest to MDSO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BVN | 6 | 22122 | 2 |

| EV | 17 | 125546 | 2 |

| VEON | 9 | 27679 | 2 |

| POR | 19 | 249916 | 3 |

| Average | 12.75 | 106316 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.75 hedge funds with bullish positions and the average amount invested in these stocks was $106 million. That figure was $146 million in MDSO’s case. Portland General Electric Company (NYSE:POR) is the most popular stock in this table. On the other hand Compania de Minas Buenaventura SA (NYSE:BVN) is the least popular one with only 6 bullish hedge fund positions. Medidata Solutions Inc (NASDAQ:MDSO) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on MDSO as the stock returned 33.5% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.