The government requires hedge funds and wealthy investors that crossed the $100 million equity holdings threshold are required to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on March 31. We at Insider Monkey have made an extensive database of nearly 750 of those elite funds and famous investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Marvell Technology Group Ltd. (NASDAQ:MRVL) based on those filings.

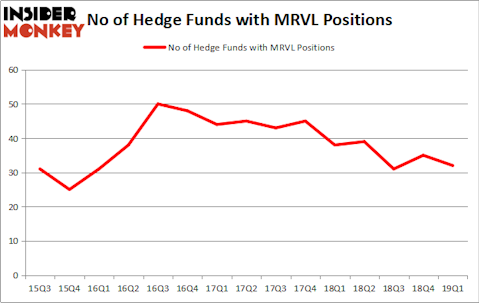

Is Marvell Technology Group Ltd. (NASDAQ:MRVL) going to take off soon? Hedge funds are getting less optimistic. The number of bullish hedge fund positions were trimmed by 3 in recent months. Our calculations also showed that MRVL isn’t among the 30 most popular stocks among hedge funds. MRVL was in 32 hedge funds’ portfolios at the end of March. There were 35 hedge funds in our database with MRVL positions at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the recent hedge fund action regarding Marvell Technology Group Ltd. (NASDAQ:MRVL).

Hedge fund activity in Marvell Technology Group Ltd. (NASDAQ:MRVL)

At Q1’s end, a total of 32 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -9% from the previous quarter. By comparison, 38 hedge funds held shares or bullish call options in MRVL a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Starboard Value LP held the most valuable stake in Marvell Technology Group Ltd. (NASDAQ:MRVL), which was worth $394.4 million at the end of the first quarter. On the second spot was Citadel Investment Group which amassed $360.4 million worth of shares. Moreover, Point72 Asset Management, Alyeska Investment Group, and Highline Capital Management were also bullish on Marvell Technology Group Ltd. (NASDAQ:MRVL), allocating a large percentage of their portfolios to this stock.

Because Marvell Technology Group Ltd. (NASDAQ:MRVL) has witnessed a decline in interest from the smart money, logic holds that there were a few hedge funds that elected to cut their positions entirely by the end of the third quarter. Intriguingly, Richard Barrera’s Roystone Capital Partners dropped the biggest stake of the 700 funds watched by Insider Monkey, totaling about $33.1 million in stock, and Peter S. Park’s Park West Asset Management was right behind this move, as the fund sold off about $27.5 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds by the end of the third quarter.

Let’s go over hedge fund activity in other stocks similar to Marvell Technology Group Ltd. (NASDAQ:MRVL). We will take a look at Expeditors International of Washington, Inc. (NASDAQ:EXPD), Apache Corporation (NYSE:APA), Arch Capital Group Ltd. (NASDAQ:ACGL), and W.P. Carey Inc. REIT (NYSE:WPC). This group of stocks’ market valuations resemble MRVL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXPD | 30 | 511934 | 6 |

| APA | 28 | 616390 | -1 |

| ACGL | 12 | 1100250 | -1 |

| WPC | 13 | 55062 | 3 |

| Average | 20.75 | 570909 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.75 hedge funds with bullish positions and the average amount invested in these stocks was $571 million. That figure was $1469 million in MRVL’s case. Expeditors International of Washington, Inc. (NASDAQ:EXPD) is the most popular stock in this table. On the other hand Arch Capital Group Ltd. (NASDAQ:ACGL) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Marvell Technology Group Ltd. (NASDAQ:MRVL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on MRVL as the stock returned 11.9% during the same period and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.