Is Lydall, Inc. (NYSE:LDL) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before spending days of research on it. Given their 2 and 20 payment structure, hedge funds have more incentives and resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

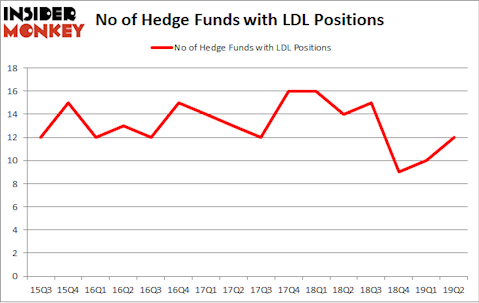

Lydall, Inc. (NYSE:LDL) investors should pay attention to an increase in hedge fund interest lately. Our calculations also showed that LDL isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

In addition to following the biggest hedge funds for investment ideas, we also share stock pitches from conferences, investor letters and other sources like this one where the fund manager is talking about two under the radar 1000% return potential stocks: first one in internet infrastructure and the second in the heart of advertising market. We use hedge fund buy/sell signals to determine whether to conduct in-depth analysis of these stock ideas which take days. We’re going to take a peek at the new hedge fund action surrounding Lydall, Inc. (NYSE:LDL).

How have hedgies been trading Lydall, Inc. (NYSE:LDL)?

At the end of the second quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 20% from the previous quarter. On the other hand, there were a total of 14 hedge funds with a bullish position in LDL a year ago. With hedgies’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Royce & Associates, managed by Chuck Royce, holds the most valuable position in Lydall, Inc. (NYSE:LDL). Royce & Associates has a $8.8 million position in the stock, comprising 0.1% of its 13F portfolio. On Royce & Associates’s heels is Millennium Management, managed by Israel Englander, which holds a $4.6 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Remaining peers that hold long positions consist of Renaissance Technologies, Ken Griffin’s Citadel Investment Group and D. E. Shaw’s D E Shaw.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Tudor Investment Corp, managed by Paul Tudor Jones, assembled the most outsized position in Lydall, Inc. (NYSE:LDL). Tudor Investment Corp had $0.7 million invested in the company at the end of the quarter. Cliff Asness’s AQR Capital Management also made a $0.6 million investment in the stock during the quarter. The only other fund with a brand new LDL position is Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks similar to Lydall, Inc. (NYSE:LDL). We will take a look at Limoneira Company (NASDAQ:LMNR), New Age Beverages Corporation (NASDAQ:NBEV), Civista Bancshares, Inc. (NASDAQ:CIVB), and Rimini Street, Inc. (NASDAQ:RMNI). All of these stocks’ market caps are closest to LDL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LMNR | 2 | 513 | 0 |

| NBEV | 4 | 2369 | -4 |

| CIVB | 4 | 24223 | -1 |

| RMNI | 6 | 12325 | 2 |

| Average | 4 | 9858 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $10 million. That figure was $21 million in LDL’s case. Rimini Street, Inc. (NASDAQ:RMNI) is the most popular stock in this table. On the other hand Limoneira Company (NASDAQ:LMNR) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Lydall, Inc. (NYSE:LDL) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on LDL as the stock returned 23.3% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.