While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and deteriorating expectations towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the third quarter and hedging or reducing many of their long positions. Some fund managers are betting on Dow hitting 40,000 to generate strong returns. However, as we know, big investors usually buy stocks with strong fundamentals that can deliver gains both in bull and bear markets, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Luckin Coffee Inc. (NASDAQ:LK).

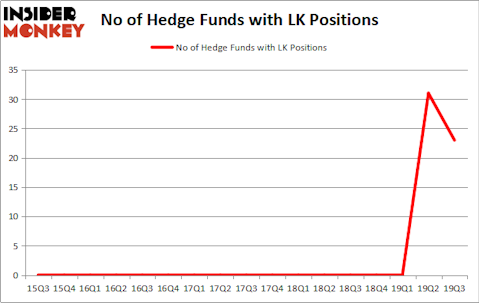

Is Luckin Coffee Inc. (NASDAQ:LK) ready to rally soon? Hedge funds are turning less bullish. The number of bullish hedge fund positions went down by 8 recently. Our calculations also showed that LK isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings). LK was in 23 hedge funds’ portfolios at the end of the third quarter of 2019. There were 31 hedge funds in our database with LK holdings at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are viewed as unimportant, outdated financial vehicles of yesteryear. While there are over 8000 funds in operation today, Our researchers choose to focus on the leaders of this club, about 750 funds. These money managers shepherd the lion’s share of the hedge fund industry’s total capital, and by observing their top picks, Insider Monkey has come up with many investment strategies that have historically outpaced the market. Insider Monkey’s flagship short hedge fund strategy outrun the S&P 500 short ETFs by around 20 percentage points annually since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Richard Chilton of Chilton Investment Company

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. We’re going to analyze the new hedge fund action encompassing Luckin Coffee Inc. (NASDAQ:LK).

What have hedge funds been doing with Luckin Coffee Inc. (NASDAQ:LK)?

Heading into the fourth quarter of 2019, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -26% from one quarter earlier. By comparison, 0 hedge funds held shares or bullish call options in LK a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Alkeon Capital Management was the largest shareholder of Luckin Coffee Inc. (NASDAQ:LK), with a stake worth $60.9 million reported as of the end of September. Trailing Alkeon Capital Management was Darsana Capital Partners, which amassed a stake valued at $47.5 million. Melvin Capital Management, Southpoint Capital Advisors, and Millennium Management were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position DSAM Partners allocated the biggest weight to Luckin Coffee Inc. (NASDAQ:LK), around 2.68% of its 13F portfolio. Stormborn Capital Management is also relatively very bullish on the stock, designating 2.59 percent of its 13F equity portfolio to LK.

Because Luckin Coffee Inc. (NASDAQ:LK) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there were a few funds that decided to sell off their full holdings last quarter. At the top of the heap, Aaron Cowen’s Suvretta Capital Management dumped the biggest investment of all the hedgies watched by Insider Monkey, valued at an estimated $21.2 million in stock, and Rob Citrone’s Discovery Capital Management was right behind this move, as the fund dumped about $12.7 million worth. These moves are important to note, as total hedge fund interest was cut by 8 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Luckin Coffee Inc. (NASDAQ:LK). We will take a look at Brunswick Corporation (NYSE:BC), WPX Energy Inc (NYSE:WPX), Landstar System, Inc. (NASDAQ:LSTR), and The Macerich Company (NYSE:MAC). This group of stocks’ market caps match LK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BC | 28 | 564304 | -2 |

| WPX | 44 | 582500 | 4 |

| LSTR | 19 | 191180 | -3 |

| MAC | 22 | 136466 | 1 |

| Average | 28.25 | 368613 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $369 million. That figure was $300 million in LK’s case. WPX Energy Inc (NYSE:WPX) is the most popular stock in this table. On the other hand Landstar System, Inc. (NASDAQ:LSTR) is the least popular one with only 19 bullish hedge fund positions. Luckin Coffee Inc. (NASDAQ:LK) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on LK as the stock returned 58.7% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.