The Insider Monkey team has completed processing the quarterly 13F filings for the June quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards J&J Snack Foods Corp. (NASDAQ:JJSF).

Is J&J Snack Foods Corp. (NASDAQ:JJSF) going to take off soon? Hedge funds are taking a pessimistic view. The number of long hedge fund bets shrunk by 1 recently. Our calculations also showed that JJSF isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a lot of methods shareholders use to assess publicly traded companies. Two of the less known methods are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the top money managers can outperform their index-focused peers by a solid margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the key hedge fund action regarding J&J Snack Foods Corp. (NASDAQ:JJSF).

How have hedgies been trading J&J Snack Foods Corp. (NASDAQ:JJSF)?

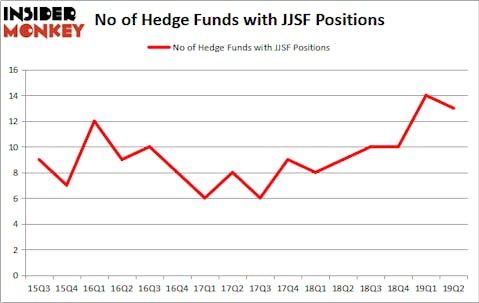

At Q2’s end, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -7% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards JJSF over the last 16 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in J&J Snack Foods Corp. (NASDAQ:JJSF) was held by Renaissance Technologies, which reported holding $51.5 million worth of stock at the end of March. It was followed by GLG Partners with a $7.5 million position. Other investors bullish on the company included GAMCO Investors, Fisher Asset Management, and Millennium Management.

Judging by the fact that J&J Snack Foods Corp. (NASDAQ:JJSF) has witnessed declining sentiment from the smart money, it’s safe to say that there were a few hedge funds that slashed their positions entirely last quarter. At the top of the heap, Mike Vranos’s Ellington dropped the biggest position of all the hedgies watched by Insider Monkey, totaling an estimated $1 million in stock, and Paul Tudor Jones’s Tudor Investment Corp was right behind this move, as the fund sold off about $0.2 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest dropped by 1 funds last quarter.

Let’s also examine hedge fund activity in other stocks similar to J&J Snack Foods Corp. (NASDAQ:JJSF). These stocks are SINA Corp (NASDAQ:SINA), TerraForm Power Inc (NASDAQ:TERP), Corporate Office Properties Trust (NYSE:OFC), and Sibanye Gold Ltd (NYSE:SBGL). All of these stocks’ market caps resemble JJSF’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SINA | 19 | 314481 | -5 |

| TERP | 12 | 163216 | 1 |

| OFC | 16 | 183349 | 4 |

| SBGL | 9 | 92525 | -3 |

| Average | 14 | 188393 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $188 million. That figure was $81 million in JJSF’s case. SINA Corp (NASDAQ:SINA) is the most popular stock in this table. On the other hand Sibanye Gold Ltd (NYSE:SBGL) is the least popular one with only 9 bullish hedge fund positions. J&J Snack Foods Corp. (NASDAQ:JJSF) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on JJSF as the stock returned 19.6% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.