There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze IMAX Corporation (NYSE:IMAX).

Hedge fund interest in IMAX Corporation (NYSE:IMAX) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare IMAX to other stocks including Nevro Corp (NYSE:NVRO), Sangamo Therapeutics, Inc. (NASDAQ:SGMO), and Frank’s International N.V. (NYSE:FI) to get a better sense of its popularity.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to analyze the new hedge fund action surrounding IMAX Corporation (NYSE:IMAX).

What have hedge funds been doing with IMAX Corporation (NYSE:IMAX)?

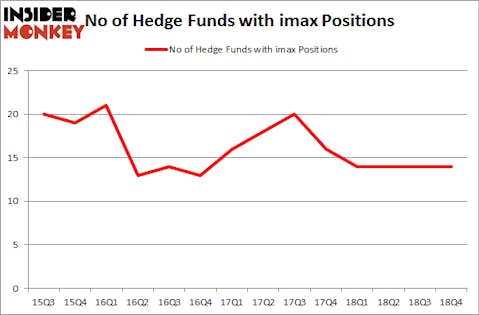

At the end of the fourth quarter, a total of 14 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in IMAX over the last 14 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Two Sigma Advisors, managed by John Overdeck and David Siegel, holds the number one position in IMAX Corporation (NYSE:IMAX). Two Sigma Advisors has a $7 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second largest stake is held by Point72 Asset Management, managed by Steve Cohen, which holds a $5.7 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions consist of Noam Gottesman’s GLG Partners, David Forster and Peter Wilton’s IBIS Capital Partners and Richard McGuire’s Marcato Capital Management.

Judging by the fact that IMAX Corporation (NYSE:IMAX) has witnessed a decline in interest from the smart money, we can see that there was a specific group of money managers who were dropping their entire stakes heading into Q3. Intriguingly, Ken Griffin’s Citadel Investment Group said goodbye to the biggest investment of the “upper crust” of funds monitored by Insider Monkey, comprising an estimated $3.6 million in stock. Jack Ripsteen’s fund, Potrero Capital Research, also dumped its stock, about $3.2 million worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as IMAX Corporation (NYSE:IMAX) but similarly valued. These stocks are Nevro Corp (NYSE:NVRO), Sangamo Therapeutics, Inc. (NASDAQ:SGMO), Frank’s International N.V. (NYSE:FI), and PROS Holdings, Inc. (NYSE:PRO). This group of stocks’ market caps are closest to IMAX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVRO | 20 | 296016 | -4 |

| SGMO | 23 | 79711 | -3 |

| FI | 12 | 24473 | 1 |

| PRO | 15 | 111619 | -1 |

| Average | 17.5 | 127955 | -1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $128 million. That figure was $28 million in IMAX’s case. Sangamo Therapeutics, Inc. (NASDAQ:SGMO) is the most popular stock in this table. On the other hand Frank’s International N.V. (NYSE:FI) is the least popular one with only 12 bullish hedge fund positions. IMAX Corporation (NYSE:IMAX) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on IMAX as the stock returned 33.4% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.