The fourth quarter was a rough one for most investors, as fears of a rising interest rate environment in the U.S, a trade war with China, and a more or less stagnant Europe, weighed heavily on the minds of investors. Both the S&P 500 and Russell 2000 sank as a result, with the Russell 2000, which is composed of smaller companies, being hit especially hard. This was primarily due to hedge funds, which are big supporters of small-cap stocks, pulling some of their capital out of the volatile markets during this time. Let’s look at how this market volatility affected the sentiment of hedge funds towards GCI Liberty, Inc. (NASDAQ:GLIBA), and what that likely means for the prospects of the company and its stock.

GCI Liberty, Inc. (NASDAQ:GLIBA) investors should pay attention to an increase in support from the world’s most elite money managers recently. Our calculations also showed that GLIBA isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are assumed to be slow, old investment tools of years past. While there are more than 8000 funds trading at present, Our experts look at the bigwigs of this club, around 750 funds. These hedge fund managers watch over the lion’s share of the smart money’s total capital, and by keeping track of their unrivaled stock picks, Insider Monkey has discovered a number of investment strategies that have historically surpassed Mr. Market. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to go over the latest hedge fund action surrounding GCI Liberty, Inc. (NASDAQ:GLIBA).

Hedge fund activity in GCI Liberty, Inc. (NASDAQ:GLIBA)

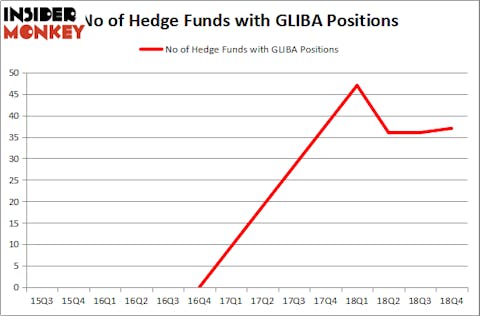

Heading into the first quarter of 2019, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 3% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards GLIBA over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in GCI Liberty, Inc. (NASDAQ:GLIBA) was held by FPR Partners, which reported holding $360 million worth of stock at the end of September. It was followed by Eagle Capital Management with a $242.5 million position. Other investors bullish on the company included Southeastern Asset Management, D E Shaw, and Makaira Partners.

As one would reasonably expect, some big names were leading the bulls’ herd. General Equity Partners, managed by Andrew Bellas, created the biggest position in GCI Liberty, Inc. (NASDAQ:GLIBA). General Equity Partners had $20.5 million invested in the company at the end of the quarter. Sander Gerber’s Hudson Bay Capital Management also made a $20.3 million investment in the stock during the quarter. The other funds with new positions in the stock are David Fiszel’s Honeycomb Asset Management, Parvinder Thiara’s Athanor Capital, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks similar to GCI Liberty, Inc. (NASDAQ:GLIBA). We will take a look at Ashland Global Holdings Inc.. (NYSE:ASH), Universal Display Corporation (NASDAQ:OLED), Brixmor Property Group Inc (NYSE:BRX), and National Fuel Gas Company (NYSE:NFG). This group of stocks’ market values are closest to GLIBA’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ASH | 37 | 1143105 | 5 |

| OLED | 10 | 80618 | -10 |

| BRX | 17 | 321828 | -1 |

| NFG | 16 | 216607 | 0 |

| Average | 20 | 440540 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $441 million. That figure was $1382 million in GLIBA’s case. Ashland Global Holdings Inc.. (NYSE:ASH) is the most popular stock in this table. On the other hand Universal Display Corporation (NASDAQ:OLED) is the least popular one with only 10 bullish hedge fund positions. GCI Liberty, Inc. (NASDAQ:GLIBA) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on GLIBA as the stock returned 41.5% and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.