Before putting in our own effort and resources into finding a good investment, we can quickly utilize hedge fund expertise to give us a quick glimpse of whether that stock could make for a good addition to our portfolios. The odds are not exactly stacked in investors’ favor when it comes to beating the market, as evidenced by the fact that less than 49% of the stocks in the S&P 500 did so during the second quarter. The stats were even worse in recent years when most of the advances in the market were due to large gains by FAANG stocks. However, one bright side for individual investors was the strong performance of hedge funds’ top consensus picks. This year hedge funds’ top 20 stock picks outperformed the S&P 500 Index by 6.6 percentage points through May 30th. Thus, we can see that the tireless research and efforts of hedge funds to identify winning stocks can work to our advantage when we know how to use the data. While not all of their picks will be winners, our odds are much better following their best stock picks than trying to go it alone.

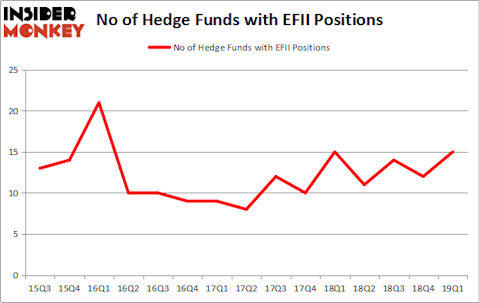

Is Electronics For Imaging, Inc. (NASDAQ:EFII) a worthy investment today? Money managers are betting on the stock. The number of long hedge fund bets advanced by 3 recently. Our calculations also showed that EFII isn’t among the 30 most popular stocks among hedge funds. EFII was in 15 hedge funds’ portfolios at the end of March. There were 12 hedge funds in our database with EFII positions at the end of the previous quarter.

In the eyes of most stock holders, hedge funds are assumed to be worthless, outdated investment vehicles of yesteryear. While there are more than 8000 funds trading at the moment, Our experts look at the bigwigs of this club, about 750 funds. These money managers control the majority of all hedge funds’ total asset base, and by keeping an eye on their top stock picks, Insider Monkey has identified a few investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by around 5 percentage points annually since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to check out the latest hedge fund action surrounding Electronics For Imaging, Inc. (NASDAQ:EFII).

What does smart money think about Electronics For Imaging, Inc. (NASDAQ:EFII)?

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 25% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards EFII over the last 15 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were adding to their holdings substantially (or already accumulated large positions).

Among these funds, Cadian Capital held the most valuable stake in Electronics For Imaging, Inc. (NASDAQ:EFII), which was worth $75.6 million at the end of the first quarter. On the second spot was Greenvale Capital which amassed $23.2 million worth of shares. Moreover, Rima Senvest Management, Arrowstreet Capital, and Two Sigma Advisors were also bullish on Electronics For Imaging, Inc. (NASDAQ:EFII), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key money managers were breaking ground themselves. Osterweis Capital Management, managed by John Osterweis, established the biggest position in Electronics For Imaging, Inc. (NASDAQ:EFII). Osterweis Capital Management had $27.1 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $9.5 million investment in the stock during the quarter. The following funds were also among the new EFII investors: Jim Simons’s Renaissance Technologies, Sander Gerber’s Hudson Bay Capital Management, and Dmitry Balyasny’s Balyasny Asset Management.

Let’s go over hedge fund activity in other stocks similar to Electronics For Imaging, Inc. (NASDAQ:EFII). These stocks are American Finance Trust, Inc. (NASDAQ:AFIN), Amerisafe, Inc. (NASDAQ:AMSF), Fate Therapeutics Inc (NASDAQ:FATE), and Carrizo Oil & Gas, Inc. (NASDAQ:CRZO). This group of stocks’ market caps are similar to EFII’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| AFIN | 9 | 16313 | 6 |

| AMSF | 12 | 18697 | 1 |

| FATE | 18 | 413631 | 3 |

| CRZO | 15 | 114113 | 2 |

| Average | 13.5 | 140689 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $140 million in EFII’s case. Fate Therapeutics Inc (NASDAQ:FATE) is the most popular stock in this table. On the other hand American Finance Trust, Inc. (NASDAQ:AFIN) is the least popular one with only 9 bullish hedge fund positions. Electronics For Imaging, Inc. (NASDAQ:EFII) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Hedge funds were also right about betting on EFII as the stock returned 37.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.