The latest 13F reporting period has come and gone, and Insider Monkey is again at the forefront when it comes to making use of this gold mine of data. We at Insider Monkey have gone over 730 13F filings that hedge funds and well-known value investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of June 28th. In this article we look at what those investors think of D.R. Horton, Inc. (NYSE:DHI).

D.R. Horton, Inc. (NYSE:DHI) has experienced an increase in hedge fund sentiment recently. Our calculations also showed that DHI isn’t among the 30 most popular stocks among hedge funds (view the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are perceived as unimportant, old investment vehicles of years past. While there are greater than 8000 funds in operation at the moment, We hone in on the crème de la crème of this group, approximately 750 funds. These hedge fund managers direct the lion’s share of the smart money’s total capital, and by tracking their matchless stock picks, Insider Monkey has identified several investment strategies that have historically defeated the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by around 5 percentage points annually since its inception in May 2014. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 25.7% since February 2017 (through September 30th) even though the market was up more than 33% during the same period. We just shared a list of 10 short targets in our latest quarterly update .

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to view the fresh hedge fund action regarding D.R. Horton, Inc. (NYSE:DHI).

What have hedge funds been doing with D.R. Horton, Inc. (NYSE:DHI)?

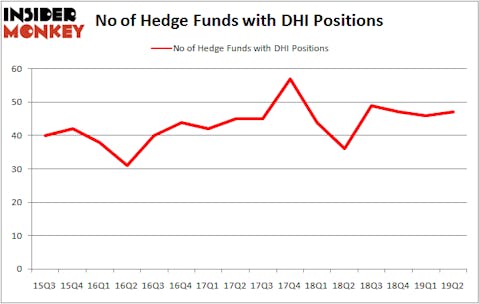

At Q2’s end, a total of 47 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 2% from the previous quarter. By comparison, 36 hedge funds held shares or bullish call options in DHI a year ago. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Lone Pine Capital held the most valuable stake in D.R. Horton, Inc. (NYSE:DHI), which was worth $536.1 million at the end of the second quarter. On the second spot was Long Pond Capital which amassed $495.7 million worth of shares. Moreover, Egerton Capital Limited, Greenhaven Associates, and D1 Capital Partners were also bullish on D.R. Horton, Inc. (NYSE:DHI), allocating a large percentage of their portfolios to this stock.

As industrywide interest jumped, specific money managers have been driving this bullishness. Egerton Capital Limited, managed by John Armitage, initiated the most valuable position in D.R. Horton, Inc. (NYSE:DHI). Egerton Capital Limited had $387.5 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $36.4 million position during the quarter. The following funds were also among the new DHI investors: Clint Carlson’s Carlson Capital, Karim Abbadi and Edward McBride’s Centiva Capital, and Peter Seuss’s Prana Capital Management.

Let’s go over hedge fund activity in other stocks similar to D.R. Horton, Inc. (NYSE:DHI). We will take a look at CDW Corporation (NASDAQ:CDW), Equifax Inc. (NYSE:EFX), First Republic Bank (NYSE:FRC), and Maxim Integrated Products Inc. (NASDAQ:MXIM). All of these stocks’ market caps are similar to DHI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CDW | 29 | 1244470 | 1 |

| EFX | 34 | 1565232 | 10 |

| FRC | 22 | 657860 | 4 |

| MXIM | 28 | 254436 | 1 |

| Average | 28.25 | 930500 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.25 hedge funds with bullish positions and the average amount invested in these stocks was $930 million. That figure was $2949 million in DHI’s case. Equifax Inc. (NYSE:EFX) is the most popular stock in this table. On the other hand First Republic Bank (NYSE:FRC) is the least popular one with only 22 bullish hedge fund positions. Compared to these stocks D.R. Horton, Inc. (NYSE:DHI) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on DHI as the stock returned 22.6% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.