You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund managers like Jeff Ubben, George Soros and Seth Klarman hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

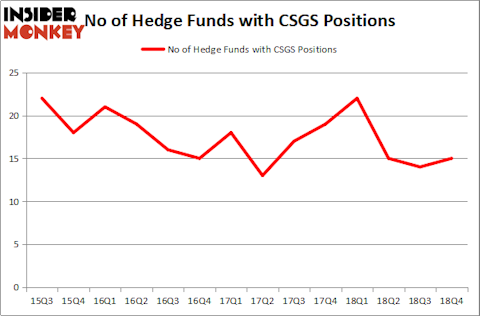

CSG Systems International, Inc. (NASDAQ:CSGS) shareholders have witnessed an increase in hedge fund interest of late. Our calculations also showed that CSGS isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s go over the key hedge fund action regarding CSG Systems International, Inc. (NASDAQ:CSGS).

How have hedgies been trading CSG Systems International, Inc. (NASDAQ:CSGS)?

At Q4’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 7% from the second quarter of 2018. On the other hand, there were a total of 22 hedge funds with a bullish position in CSGS a year ago. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in CSG Systems International, Inc. (NASDAQ:CSGS) was held by Renaissance Technologies, which reported holding $71.6 million worth of stock at the end of December. It was followed by Polar Capital with a $30.4 million position. Other investors bullish on the company included Citadel Investment Group, Millennium Management, and D E Shaw.

As industrywide interest jumped, specific money managers have been driving this bullishness. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, established the most valuable position in CSG Systems International, Inc. (NASDAQ:CSGS). Marshall Wace LLP had $1.7 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also initiated a $0.5 million position during the quarter.

Let’s now review hedge fund activity in other stocks similar to CSG Systems International, Inc. (NASDAQ:CSGS). These stocks are Sykes Enterprises, Incorporated (NASDAQ:SYKE), Hollysys Automation Technologies Ltd (NASDAQ:HOLI), Sleep Number Corporation (NASDAQ:SNBR), and Engility Holdings Inc (NYSE:EGL). This group of stocks’ market valuations are closest to CSGS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYKE | 16 | 39663 | 0 |

| HOLI | 15 | 70270 | -1 |

| SNBR | 18 | 75967 | 4 |

| EGL | 14 | 72165 | -3 |

| Average | 15.75 | 64516 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $65 million. That figure was $133 million in CSGS’s case. Sleep Number Corporation (NASDAQ:SNBR) is the most popular stock in this table. On the other hand Engility Holdings Inc (NYSE:EGL) is the least popular one with only 14 bullish hedge fund positions. CSG Systems International, Inc. (NASDAQ:CSGS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CSGS as the stock returned 38.6% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.