At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Tiger Global because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

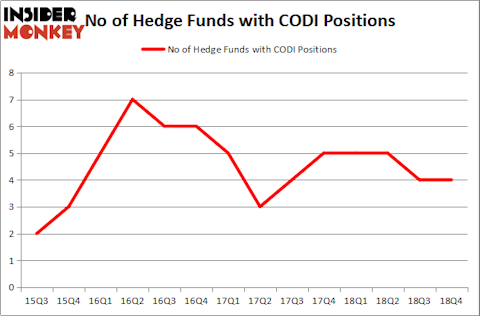

Compass Diversified Holdings LLC (NYSE:CODI) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 4 hedge funds’ portfolios at the end of December. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Revance Therapeutics Inc (NASDAQ:RVNC), Apellis Pharmaceuticals, Inc. (NASDAQ:APLS), and Herc Holdings Inc. (NYSE:HRI) to gather more data points.

In the financial world there are many methods market participants employ to value stocks. A duo of the most useful methods are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can outperform the S&P 500 by a very impressive amount (see the details here).

We’re going to check out the fresh hedge fund action encompassing Compass Diversified Holdings LLC (NYSE:CODI).

How are hedge funds trading Compass Diversified Holdings LLC (NYSE:CODI)?

At the end of the fourth quarter, a total of 4 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. By comparison, 5 hedge funds held shares or bullish call options in CODI a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Renaissance Technologies, managed by Jim Simons, holds the most valuable position in Compass Diversified Holdings LLC (NYSE:CODI). Renaissance Technologies has a $1.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is Robert B. Gillam of McKinley Capital Management, with a $1.1 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other peers with similar optimism encompass Ken Griffin’s Citadel Investment Group and Israel Englander’s Millennium Management.

Earlier we told you that the aggregate hedge fund interest in the stock was unchanged and we view this as a negative development. Even though there weren’t any hedge funds dumping their holdings during the third quarter, there weren’t any hedge funds initiating brand new positions. This indicates that hedge funds, at the very best, perceive this stock as dead money and they haven’t identified any viable catalysts that can attract investor attention.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Compass Diversified Holdings LLC (NYSE:CODI) but similarly valued. These stocks are Revance Therapeutics Inc (NASDAQ:RVNC), Apellis Pharmaceuticals, Inc. (NASDAQ:APLS), Herc Holdings Inc. (NYSE:HRI), and Acorda Therapeutics Inc (NASDAQ:ACOR). This group of stocks’ market values match CODI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RVNC | 9 | 27020 | -2 |

| APLS | 17 | 171412 | 3 |

| HRI | 27 | 323111 | 3 |

| ACOR | 22 | 180486 | 1 |

| Average | 18.75 | 175507 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.75 hedge funds with bullish positions and the average amount invested in these stocks was $176 million. That figure was $4 million in CODI’s case. Herc Holdings Inc. (NYSE:HRI) is the most popular stock in this table. On the other hand Revance Therapeutics Inc (NASDAQ:RVNC) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks Compass Diversified Holdings LLC (NYSE:CODI) is even less popular than RVNC. Hedge funds clearly dropped the ball on CODI as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. A small number of hedge funds were also right about betting on CODI as the stock returned 35.4% and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.